Bubble Talk

A hot topic of conversation these days is the prospect of another real estate bubble. People wonder if prices can continue at their current pace and some fear a repeat of 2008.

Because we get asked about this topic so often from our clients, we thought it would make sense to ask our in-house expert, Matthew Gardner.

Matthew is our Chief Economist and was our Keynote Speaker at the Windermere Annual Market Forecast.

During the Forecast presentation, he discussed the bubble concerns and laid out his reasons why he sees no potential of prices bursting along the Front Range.

Quite the opposite actually, he sees that prices will continue to go up, but just not as fast as they have been.

His reasons for no bubble bursting are as follows:

- Record-low inventory – prices cannot crash without a glut of supply on the market

- Highly-qualified buyers – lending guidelines are more stringent today than they have been in our lifetime

- Growing jobs – job growth in Colorado is projected to far outpace the national average this coming year

So, we project a healthy real estate market in 2021.

To see a replay of the Forecast presentation, simply reach out to us, we would be happy to send you the recording.

Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

What a difference a quarter makes! Following the massive job losses Colorado experienced starting in February—the state shed over 342,000 positions between February and April—the turnaround has been palpable. Through August, Colorado has recovered 178,000 of the jobs lost due to COVID-19, adding 107,500 jobs over the past three months, an increase of 4.2%. All regions saw a significant number of jobs returning. The most prominent was in the Denver metropolitan service area (MSA), where 78,800 jobs returned in the quarter.

Although employment in all markets is recovering, there is still a way to go to get back to pre-pandemic employment levels. The recovery in jobs has naturally led the unemployment rate to drop: the state is now at a respectable 6.7%, down from a peak of 12.2%. Regionally, all areas continue to see their unemployment rates contract. I would note that the Fort Collins and Boulder MSA unemployment rates are now below 6%. Cases of COVID-19 continue to rise, which is troubling, but rising rates have only slowed—not stopped—the economic recovery. Moreover, it has had no noticeable impact on the state’s housing market.

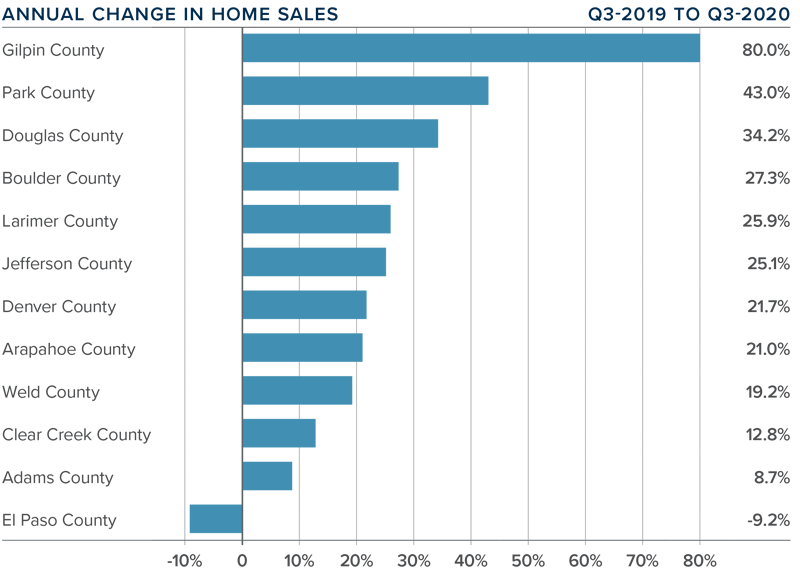

HOME SALES

- In the third quarter of 2020, 15,065 homes sold. This represents an increase of 20.4% over the third quarter of 2019, and a remarkable 52.7% increase over the second quarter of this year.

- Home sales rose in all markets other than El Paso compared to the second quarter of 2019. I believe sales are only limited by the number of homes on the market.

- Inventory levels remain remarkably low, with the average number of homes for sale down 44.5% from the same period in 2019. Listing activity was 17.8% lower than in the second quarter of 2020.

- Even given the relative lack of inventory, pending sales rose 17.8% from the second quarter, suggesting that closings for the final quarter of the year will be positive.

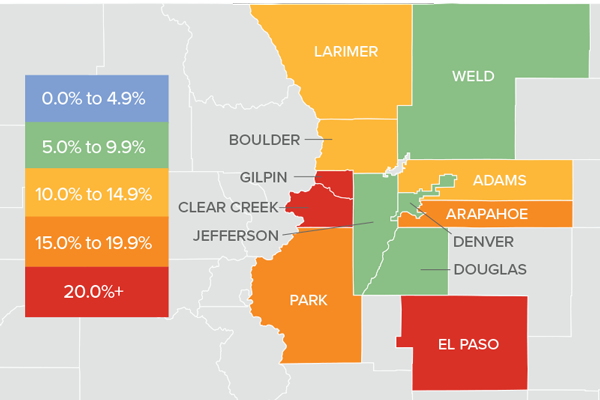

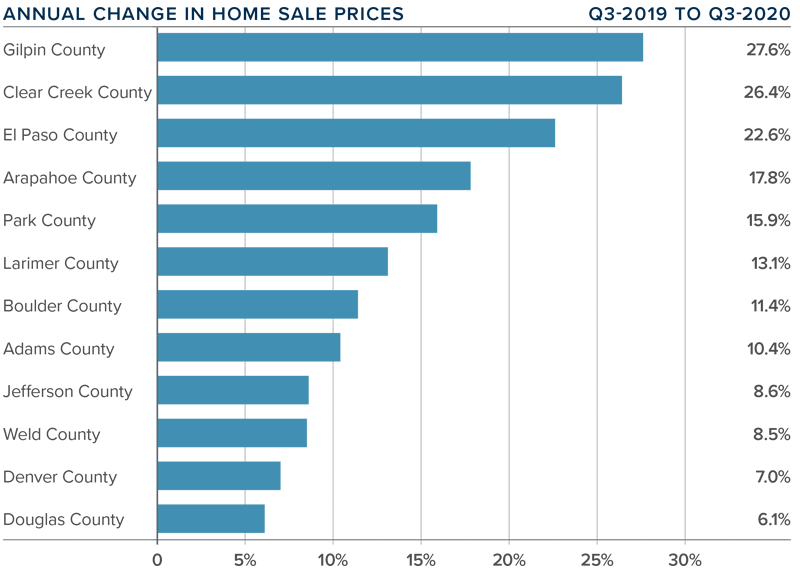

HOME PRICES

- After taking a pause in the second quarter, home prices rose significantly in the third quarter, with prices up 11.9% year-over

-year to an average of $523,193. Prices were up 7.4% compared to the second quarter of this year.

-year to an average of $523,193. Prices were up 7.4% compared to the second quarter of this year. - Interest rates have been dropping. Although I do not see there being room for them to drop much further, they are unlikely to rise significantly. This is allowing prices to rise at above-average rates.

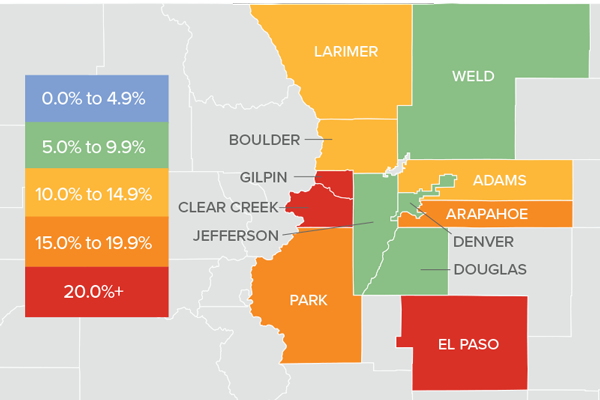

- Year-over-year, prices rose across all markets covered by this report. El Paso, Clear Creek, and Gilpin counties saw significant price appreciation. All but four counties saw double-digit price gains.

- Affordability in many Colorado markets remains a concern, as prices are rising at a faster pace than mortgage rates have been dropping.

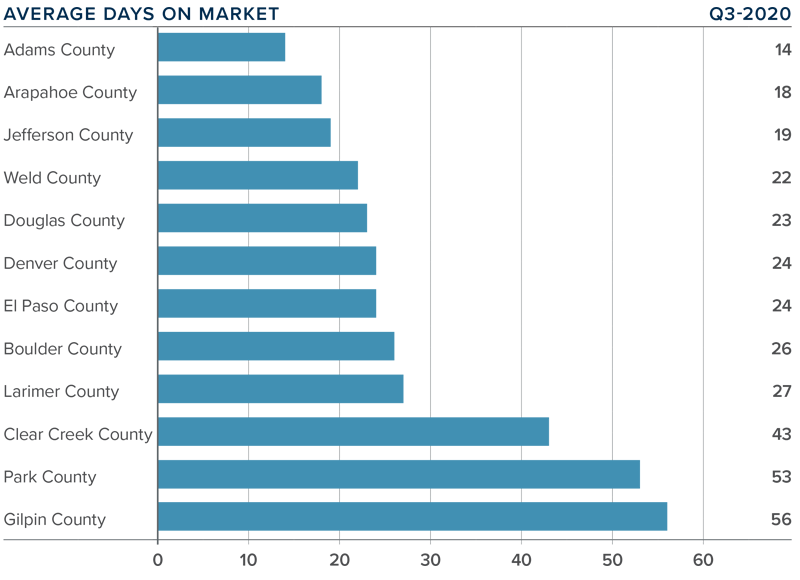

DAYS ON MARKET

- The average number of days it took to sell a home in the markets contained in this report dropped one day compared to the third quarter of 2019.

- The amount of time it took to sell a home dropped in nine counties, remained static in two, and rose in one compared to the third quarter of 2019.

- It took an average of 29 days to sell a home in the region.

- The Colorado housing market continues to demonstrate solid demand, and the short length of time it takes to sell a home suggests buyers are competing fiercely for available inventory.

CONCLUSIONS

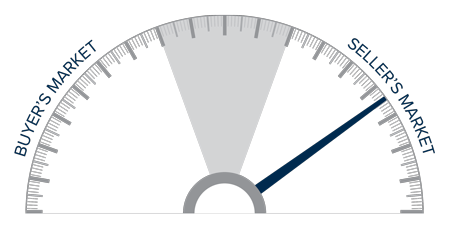

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand for housing is significant, and sales activity is only limited by the lack of available homes to buy. Prices are rising on the back of very competitive mortgage rates and a job market in recovery. I suggested in my second-quarter report that the area would experience a “brisk summer housing market” and my forecast was accurate. As such, I have moved the needle a little more in favor of home sellers.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Stat of the Month

We just completed a review of the September numbers in our market.

Here is the one number that is standing out to us – average price.

Prices are way up over last year. Here are the specific average price increases in each of our markets compared to September 2019:

- Metro Denver = 13.2%

- Larimer County = 16.9%

- Weld County = 7.4%

This change in prices has of course generated questions from our clients.

To help our clients answer questions about prices and other real estate topics, we have set up a private online event with our Chief Economist Matthew Gardner.

The event is set for Tuesday from 9:00 to 10:00.

Simply reach out to any Windermere broker to receive your registration link.

Matthew will be addressing these questions as well as many others:

- What effect will the election have on the economy and on real estate?

- How long can interest rates stay this low?

- Can prices keep appreciating at their current pace?

This online event is for the clients and friends of Windermere. If you would like to register, please connect with your Windermere broker.

Price Report

The Federal Housing Finance Authority just released their most recent quarterly report which tracks home price appreciation in the top 100 metropolitan areas in the U.S. plus appreciation in individual states.

Some significant findings from the report:

House prices have risen for 36 consecutive quarters, or since September 2011.

House prices rose in all 50 states and the District of Columbia between the second quarters of 2019 and 2020.

The top five areas for annual appreciation were:

1) Idaho 10.8%

2) Arizona 9.1%

3) Washington 8.6%

4) Utah 8.1%

5) New Mexico 7.7%.

Idaho has been the leading state for the last 7 quarters.

Colorado showed annual appreciation of 4.4%.

The areas showing the lowest annual appreciation were:

1) West Virginia 1.1%

2) North Dakota 1.1%

3) District of Columbia 1.4%

4) Illinois 2.5%

5) Alaska 2.6%.

House prices rose in 99 of the top 100 largest metropolitan areas in the U.S. over the last four quarters.

Annual price increases were greatest in Honolulu, HI, where prices increased by 11.7%.

Prices were weakest in San Francisco, where they decreased by 0.3%.

Rebound

The Case-Shiller Home Price Index tracks appreciation in the 20 largest real estate markets across the U.S.

Their most recent quarterly report was just released this week.

Metro Denver prices are up over last year by 3.89% which is just slightly higher than the average of the 20 markets.

It is interesting to see how the 20 locations have performed since the pre-Great Recession housing peak.

Turns out that Denver has done the best out of all the markets.

Since 2008, Denver home prices have appreciated 64.9%. Second-best is Dallas at 55.5% and Seattle is third at 41.2%.

Believe it or not, there are markets where average home prices have still not returned to their 2008 levels.

Las Vegas is 14.5% below 2008 and Chicago is 12.8% below.

These numbers are another indicator of the long-term health and performance of the Front Range market.

Lovely Stats

In honor of Valentine’s Day, here are some Northern Colorado stats we think you will love:

- Prices are up 3.5% compared to last year

- Inventory is up 10% which means there is more selection for buyers

- We just had the most active January in terms of closings in over 10 years

- Well over 13,000 residential properties representing $5.4 Billion of volume has sold in the last 12 months

If you would like to see a video recap of our annual Market Forecast you can watch that HERE.

Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market (which now includes Clear Creek, Gilpin, and Park Counties) is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

The Colorado economy continues to grow, adding 69,100 new non-agricultural jobs over the past 12 months, which represents a solid growth rate of 2.6%. That said, we are continuing to see a modest slowdown in employment gains, but that is to be expected at this stage of the business cycle. My latest forecast suggests that Colorado will add a total of 65,000 new jobs in 2019, representing a growth rate of 2.3%.

In November, the state unemployment rate was 3.3%, up from 3% a year ago. The increase is essentially due to an increase in the labor force, which rose by 77,279 people. On an un-seasonally adjusted basis, unemployment rates in all the markets contained in this report dropped between November 2017 and November 2018. The highest rate was in Grand Junction, but that was still a very respectable 4%. Fort Collins and Boulder had the lowest unemployment rate of 2.9%. All the regions contained in this report are essentially at full employment.

HOME SALES ACTIVITY

- In the fourth quarter of 2018, 12,911 homes sold — a drop of 13.8% compared to the last quarter of 2017 and down 22% from the third quarter.

- The only market that saw growth in sales was Clear Creek, which rose by 3.8%. This is a small market, however, and is prone to rapid swings in price as well as sales. There was a significant drop in sales in the Denver market. I will be watching closely to see if this is an anomaly or a longer-term trend. At this time, I believe the former to be true.

- Interestingly, this decline in sales in Denver came as inventory levels rose by 37%. For now, I attribute this to seasonality and expect to see sales growth return in the spring.

- Inventory growth continues to give buyers more choice, allowing them to be far more selective — and patient — before making an offer on a home. That said, well-positioned and well-priced homes are selling relatively quickly.

HOME PRICES

- Despite the rapid rise in listings and slowing home sales, prices continue to trend higher, though the rate of growth is slowing. The average home price in the region rose 6% year-over-year to $454,903. Home prices were 2% higher than in the third quarter.

- In all, the data was not very surprising. As with many markets across the country, affordability is starting to become an issue. However, the recent drop in interest rates likely stimulated buyers at the end of 2018 and I expect to see good price growth in the first quarter of 2019.

- Appreciation was strongest in Park County, where prices rose 28.2%. We can attribute this rapid increase to it being a small market. Only Gilpin County saw a drop in average home price. Though this, too, is due to it being a very small market, making it more prone to significant swings.

- As mentioned, affordability is becoming an issue in many Colorado markets and I anticipate that we will see some cooling in home price appreciation as we move through late 2019.

DAYS ON MARKET

- The average number of days it took to sell a home in Colorado rose by one day compared to the final quarter of 2017.

- The amount of time it took to sell a home dropped in four counties: Boulder, Larimer, Gilpin, and Park. The rest of the counties in this report saw days on market rise relatively modestly with the exception of the small Clear Creek market, which rose by 20 days.

- In the fourth quarter of 2018, it took an average of 38 days to sell a home in the region, but it took less than a month to sell a home in five of the eleven counties contained in this report.

- Housing demand is still there, but buyers appear to have taken a little breather. I anticipate, however, that the spring will bring more activity and rising sales.

CONCLUSIONS

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

For the fourth quarter of 2018, I continue the trend I started last summer and have moved the needle a little more in favor of buyers. I will be closely watching listing activity in the spring to see if we get any major bumps above the traditional increase because that may further slow home price growth — something that would-be buyers appear to be waiting for.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governor’s Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

The First Decade

The other day I was searching for my daughter’s cell phone number – which I haven’t memorized because I simply speed-dial it – and I realized it’s been years since I memorized anyone’s phone number. And this was just after I’d booked a flight online and selected my seat, and downloaded some new music into my iPod.

It occurred to me that these are just three examples of the tremendous changes that have happened just since the new millennium began. At the beginning of this decade, iTunes, YouTube and Facebook did not exist. Today, their combined daily views and downloads are in the billions.

An article in Newsweek a few months ago highlighted how much things have changed in a decade. The numbers are staggering and surprising.

-

- Ten years ago, a total of 400,000 text messages were sent per day; today 4.5 billion are zinging through cyberspace every day.

-

- In 2000, 12 billion emails were sent each day; today 247 billion are sent daily (many of which were in my spam filter this morning).

-

- Ten years ago, about 208 billion letters were mailed through the postal system each day; today the number of letters mailed daily is less than 176 billion.

This decade has been tumultuous, to say the least. Beyond the tremendous technology-driven advances, we are still struggling with this economy. Unemployment rates are too high. Banks are still struggling. And it is heartbreaking that people have lost their homes.

Even though there is a lot of uncertainty, I remain optimistic. I am realistic enough to know that this recovery will take awhile. But recover we will.

One thing that hasn’t changed in the past decade is the resiliency of real estate over time. When you look at median single-family home prices ten years ago versus this year, you’ll see that home values have increased since 2000. This is encouraging, especially when you consider that the stock market today is the same place it was 10 years ago. For most people, their home is worth more today than when they bought it. It might be worth less than it was two or three years ago, but real estate has never been about day trading. It’s a long-term investment. And if the last 10 years, or 100 years, are any indication, we can count on growth in home values.

And that’s a good thing.

July Median Home Prices*

2000

2010

National

$151,100

$182,600

*Source: NWMLS

What are some of the most memorable changes for you in the past decade?

What Our Expert Thinks

Here’s what our Chief Economist, Matthew Gardner, thinks about the 2019 U.S. Housing Market. He is regarded as one of the Country’s experts on real estate and is frequently quoted by leading industry publications.

• Existing Home Sales up 1.9% to 5.4 million units

• Home Prices up 4.4%

• New Home Sales up 6.9% to 695,000 (the highest since 2007)

If you want to see all of Matthew’s predictions including where interest rates are headed, get signed up for our annual Forecast. Click the link below!

https://www.eventbrite.com/o/windermere-real-estate-12011801121

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

-year to an average of $523,193. Prices were up 7.4% compared to the second quarter of this year.

-year to an average of $523,193. Prices were up 7.4% compared to the second quarter of this year.