Weeks to Months

For the first time in almost two years, there is more than a month’s worth of inventory on the market.

This means that at the current pace of sales, it would take more than a month to sell all of the homes currently for sale.

This is certainly welcome news for buyers who have been craving a less frenzied market.

Since the market took off in the summer of 2020, inventory levels have been measured in terms of weeks.

Two to three weeks of inventory was the typical measurement for the last two years.

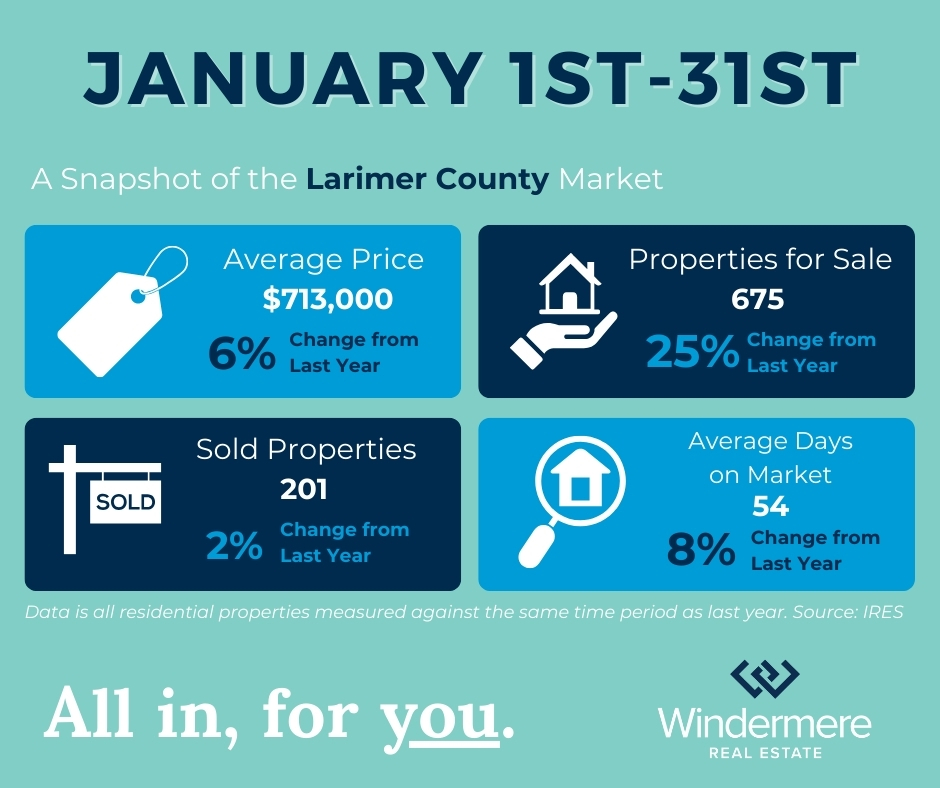

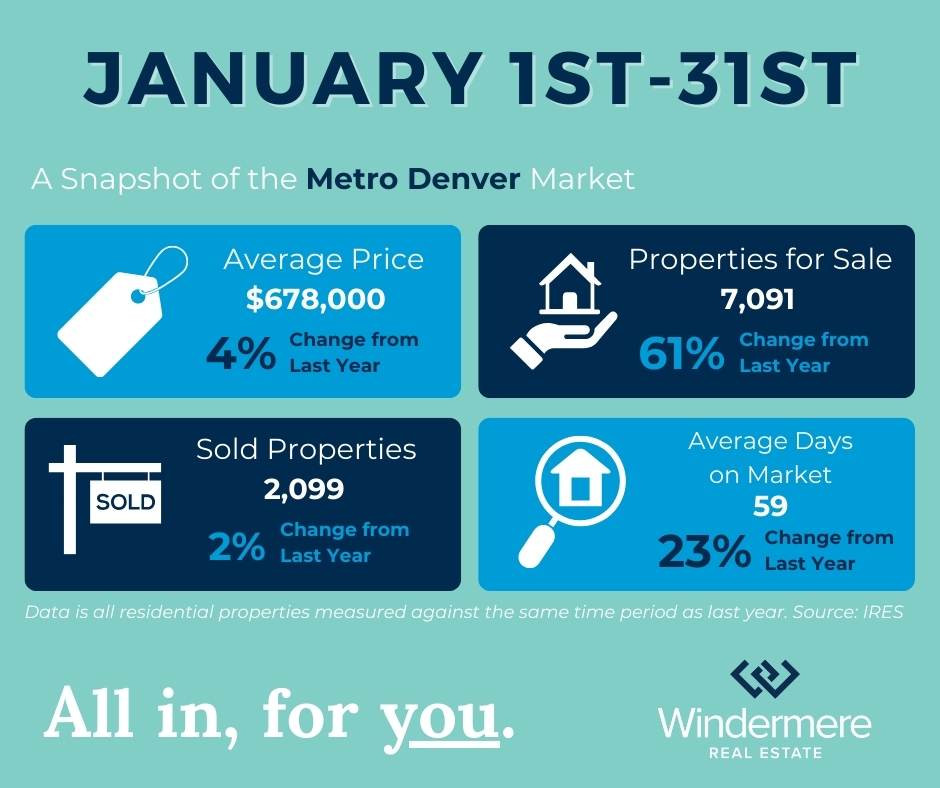

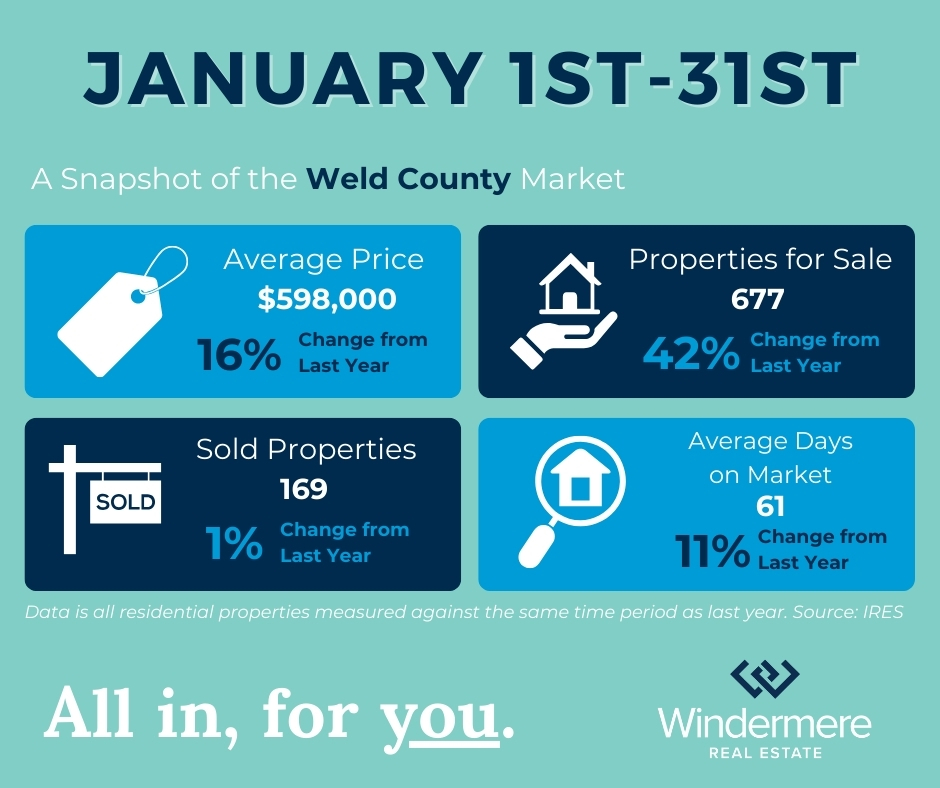

Today, inventory levels look like this:

- Larimer County = 1.1 months

- Weld County = 1.2 months

- Metro Denver = 1.2 months

The Best News

The best news in a long time has finally arrived for buyers.

Inventory is up, frenzy is down.

Buyers who were frustrated, confused and disappointed by the market a few months ago are now coming back to find a much more reasonable environment.

Demand is still high for sure. However, the intense, frenzied competition has subsided.

There is now room to breathe because there is more selection.

Here is how inventory has increased along the Front Range versus the same time a year ago:

Larimer County = 28%

Weld County = 19%

Metro Denver = 35%

These are significant increases and a trend we expect to continue.

What We Notice

Here is what we notice about the market right now:

- Listings are receiving fewer offers compared to 60 days ago – instead of 10 offers, a listing might have 2.

- There are now several instances of a listing only having one offer.

- Sellers who were overly-aggressive with their list price have to quickly reduce in order to generate activity.

- Inventory is up and in some areas significantly, giving buyers more options and flexibility.

- Home buyers who are under contract with a new home waiting for that new home to be built have been negatively impacted by rising rates.

- More buyers are considering 7 and 10-year mortgage products in order to have a lower interest rate.

- The pendulum is swinging away from the drastic seller’s market we have seen for the last 18 months.

Should I Remodel or Sell My Home As Is?

Homeowners who are preparing to sell are often faced with a dilemma about whether to remodel or sell their home in its current state. Each approach has its respective advantages and disadvantages. If you decide to remodel your home, it will likely sell for more; but the increased selling price will come at the cost of financing the remodeling projects. If you decide to sell without remodeling, you won’t spend as much money putting your home on the market, but the concern is whether you’re leaving money on the table.

Should I Remodel or Sell My Home As Is?

To answer this question, it’s important to understand the factors that could influence your decision and to work closely with your agent throughout the process.

Cost Analysis: Home Remodel vs. Selling Your Home As Is

Home Remodel

When you remodel your home before selling, you’re basically making a commitment to spend money to make money. So, it’s important to consider the kind of ROI you can expect from different remodeling projects and how much money you’re willing to spend. Start by discussing these questions with your agent. They can provide you with information on what kinds of remodels other sellers in your area are making and the returns they’re seeing as a result of those upgrades. This will help you determine the price of your home once your remodel is complete.

Then, there’s the question of whether you can complete you remodeling projects DIY or if you’ll need to hire a contractor. If hiring a contractor seems expensive, know that those costs come with the assurance that they will perform quality work and that they have the skill required to complete highly technical projects.

According to the Remodeling 2021 Cost vs. Value Report (www.costvsvalue.com1), on average, homeowners paid roughly $24,000 for a midrange bathroom remodel and about $26,000 for a minor kitchen remodel nationwide, with a 60.1% and 72.2% ROI respectively. This data shows that, for these projects, you can recoup a chunk of your costs, but they may not be the most cost-effective for you. A more budget-friendly approach to upgrading these spaces may look like repainting your kitchen cabinets, swapping out your old kitchen backsplash for a new one, refinishing your bathroom tub, or installing a new showerhead. Other high-ROI remodeling projects may allow you to get more bang for your buck, such as a garage door replacement or installing stone veneer. To appeal to sustainable-minded buyers, consider these 5 Green Upgrades that Increase Your Home Value.

Image Source: Getty Images – Image Source: stevecoleimages

Selling Your Home As Is

Deciding not to remodel your home will come with its own pros and cons. By selling as is, you may sell your home for less, but you also won’t incur the cost and headache of dealing with a remodel. And since you’ve decided to sell, you won’t be able to enjoy the fruits of the remodel, anyway. If you sell your home without remodeling, you may forego the ability to pay down the costs of buying a new home with the extra money you would have made from making those upgrades.

Market Conditions: Home Remodel vs. Selling Your Home As Is

Local market conditions may influence your decision of whether to remodel before selling your home. If you live in a seller’s market, there will be high competition amongst buyers due to a lack of inventory. You may want to capitalize on the status of the market by selling before investing time in a remodel since prices are being driven up, anyway. If you take this approach, you’ll want to strategize with your agent, since your home may lack certain features that buyers can find in comparable listings. In a seller’s market, it is still important to make necessary repairs and to stage your home.

In a buyer’s market, there are more homes on the market than active buyers. If you live in a buyer’s market, you may be more inclined to remodel your home before selling to help it stand out amongst the competition.

Timing: Home Remodel vs. Selling Your Home As Is

Don’t forget that there is a third option: to wait. For all the number crunching and market analysis, it simply may not be the right time to sell your home. Knowing that you’ll sell your home at some point in the future—but not right now—will allow you to plan your remodeling projects with more time on your hands which could make it more financially feasible to complete them.

For more information on how you can prepare to sell your home, connect with a local Windermere Real Estate agent below:

- “© 2021 Hanley Wood, Complete data from the Remodeling 2021 Cost vs. Value Report can be downloaded free at www.costvsvalue.com.”

Staggering Stat

By definition, a real estate market is balanced when there is 4 to 6 months of inventory currently for sale.

Anything less than 4 to 6 months means a Sellers’ market, anything more means a Buyers’ market.

For example, if there are 1,000 closings per month in a market, the market would be balanced if 4,000 to 6,000 homes were available for sale.

Here is a staggering stat for you…

At the current pace of sales, the Front Range market would need 6 to 7 times more inventory for the market to be balanced.

This is why we don’t see any sort of significant market correction or anything resembling ‘the market crashing.’ Bottom line, the market is still undersupplied.

Here are the numbers:

• Larimer County has 441 properties for sale and would need 2,200 to be balanced.

• Weld County has 322 properties for sale and would need 2,000 to be balanced.

• Metro Denver has 3,023 properties for sale and would need 20,000 to be balanced.

More Homes Needed

The market is in short supply.

More homes are needed to fulfill the need to buyer demand.

Compared to exactly one year ago, the supply of homes is down:

- 32.6% in Metro Denver

- 25.1% in Northern Colorado

An interesting and useful measurement we track is months of inventory. This stat tells how long it would take to sell all of the homes currently for sale at the current pace of sales.

Of course, months of supply can vary greatly by price range and location. However, this stat does a good job of explaining the overall state of the market.

Specifically, months of supply tells us if the market is in balance.

A ‘balanced’ market is when there is 4 to 6 months of supply. A buyers market occurs when the stat is higher than this range. A sellers market occurs when it is lower.

The months of supply looks like this in our market:

- 1.0 months in Metro Denver

- 1.3 months in Northern Colorado

So, the market overall is significantly under-supplied and more homes are needed to meet demand.

Which Market?

So, which is it? A buyer’s market or a seller’s market?

Well, it depends!

First, let’s define each market. According to research, a buyer’s market exists when there is more than 4-6 months of inventory on the market.

If it would take longer than 4-6 months to sell out all of the inventory currently for sale, then it is a buyer’s market.

This calculation is obviously a function of the amount of inventory on the market and the current pace of sales.

A seller’s market exists if it would take shorter than 4-6 months.

So, which is it?

It depends very much on the price range.

Here are the numbers for Northern Colorado:

• $300,000 to $400,000 = 0.9 months

• $400,000 to $500,000 = 1.9 months

• $500,000 to $750,000 = 2.3 months

• $750,000 and over = 5.8 months

So, most price ranges are a clear seller’s market. It’s not until $750,000 and over that the market starts to approach a more balanced state.

Here’s one more thing that might help you…

You probably don’t need a reminder that this is tax season.

Not only because tax returns are due in two weeks but also because you will soon receive your property tax notification in the mail.

Every two years your County re-assesses the value of your property and then sends that new value to you.

When this happens, many of our clients:

- Don’t agree with the new assessed value

- Aren’t sure what to do

- Are confused by the process

- Want to save money on property taxes

Good news! We have a webinar that will help you. On the webinar we will show you:

- How to read the information from the County

- What it means for you

- How to protest the valuation if you want

- How to get an accurate estimate of your property’s value

You can listen to the webinar live or get the recording. In any case, you can sign up at www.WindermereWorkshop.com

The webinar is April 17th at 10:00. If you can’t join live, go ahead and register so you can automatically receive the recording.

This is a complimentary online workshop for all of our clients. We hope you can join!

18 Days

We now measure inventory levels in terms of days.

Typically we measure in months. For instance, a “balanced market” is when there is 4 to 6 months of inventory currently for sale. Meaning that, in a balanced market, it would take 4 to 6 months to sell every home that is currently on the market.

Anything less than 4 months is a seller’s market. Certainly, when we measure in days, we are in an extreme seller’s market.

Today the Greeley market has 18 days of inventory, Fort Collins has 27 days, Loveland has 30, and Windsor has 51.

These are all lower than a year ago. For example, Greeley at this time last year had 27 days of inventory.

But this statistic can be misleading. Sometimes people assume that the extreme seller’s market applies to all price ranges and all locations.

Not true. When we drill down we find sub-patterns that are revealing. For example, homes in Loveland priced over $500,000 have 3 months of inventory and homes in Fort Collins over $750,000 have 5 months.

Because inventory levels tend to increase as prices increase, there becomes a distinct advantage for the move-up buyer. Today, many people can sell in an extreme seller’s market and move up to a price range with less competition and more selection.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link