Which Market?

So, which is it? A buyer’s market or a seller’s market?

Well, it depends!

First, let’s define each market. According to research, a buyer’s market exists when there is more than 4-6 months of inventory on the market.

If it would take longer than 4-6 months to sell out all of the inventory currently for sale, then it is a buyer’s market.

This calculation is obviously a function of the amount of inventory on the market and the current pace of sales.

A seller’s market exists if it would take shorter than 4-6 months.

So, which is it?

It depends very much on the price range.

Here are the numbers for Northern Colorado:

• $300,000 to $400,000 = 0.9 months

• $400,000 to $500,000 = 1.9 months

• $500,000 to $750,000 = 2.3 months

• $750,000 and over = 5.8 months

So, most price ranges are a clear seller’s market. It’s not until $750,000 and over that the market starts to approach a more balanced state.

Here’s one more thing that might help you…

You probably don’t need a reminder that this is tax season.

Not only because tax returns are due in two weeks but also because you will soon receive your property tax notification in the mail.

Every two years your County re-assesses the value of your property and then sends that new value to you.

When this happens, many of our clients:

- Don’t agree with the new assessed value

- Aren’t sure what to do

- Are confused by the process

- Want to save money on property taxes

Good news! We have a webinar that will help you. On the webinar we will show you:

- How to read the information from the County

- What it means for you

- How to protest the valuation if you want

- How to get an accurate estimate of your property’s value

You can listen to the webinar live or get the recording. In any case, you can sign up at www.WindermereWorkshop.com

The webinar is April 17th at 10:00. If you can’t join live, go ahead and register so you can automatically receive the recording.

This is a complimentary online workshop for all of our clients. We hope you can join!

Our Forecast

This past Wednesday and Thursday evenings we had the pleasure of hosting our annual Market Forecast events in Denver and Fort Collins.

Thank you to the 700 people who attended. We appreciate your support!

In case you missed the events, here are some highlights including our forecast for price appreciation in 2019:

• In 2018 Prices went up:

o 8% in Fort Collins

o 8% in Loveland

o 8.5% in Greeley

o 8% in Metro Denver

• Inventory is (finally) showing signs of increasing:

o Up 25% in Northern Colorado

o Up 45% in Metro Denver

• There are distinct differences in months of inventory across different price ranges = opportunity for the move up buyer.

• There are several reasons why we don’t see a housing bubble forming:

o New home starts along the Front Range are roughly 60% of pre-bubble highs 14 years ago.

o Americans have more equity in their homes than ever, $6 Trillion!

o The average FICO score of home buyers is significantly higher than the long-term average.

o The home ownership rate is back to the long-term average.

• Our 2019 Price Appreciation Forecast:

o 6% in Fort Collins

o 6% in Loveland

o 7% in Greeley

o 6% in Metro Denver

If you would like a copy of the presentation, go ahead and reach out to us. We would be happy to put it in your hands!

Fantastic Ranch Style Townhome in Stone Ridge!

Fantastic, hard-to-find 3 bedroom ranch-style Townhome at 3500 Swanstone Dr is located in the popular Stone Ridge neighborhood. Featuring a wide-open floor plan, vaulted ceilings & brand new carpet. This home has formal living & dining areas, spacious sun room, office & large kitchen with plenty of counter space. Finished basement with bedroom, bath, large rec room & storage. Private back yard. 2-car garage. HOA includes exterior maintenance, front lawn care, trash, snow removal & neighborhood pool. An amazing home, excellent value! Contact Jon Holsten for your private showing at 970-237-2752 for more information or click the link below for more details.

https://windermerenoco.com/listing/87552585

Ranch Style Home near Horseshoe Lake!

This 3 bedroom, 2 bathroom at 4381 Suncreek Dr in Loveland offers a ranch floor plan with a large backyard has new carpet, a spacious basement, and lots of light which makes this home a delight to live in! 2 car garage, and easy access to 287 make this centrally located home convenient no matter where you need to get in Northern Colorado. Take a look at this fantastic property today! Contact Paul Hunter for your private showing at 970-673-7285 for more information or click the link below for more details.

Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

ECONOMIC OVERVIEW

It’s good news for the state of Colorado, which saw annual employment grow in all of the metropolitan markets included in this report. The state added 63,400 non-agricultural jobs over the past 12 months, an impressive growth rate of 2.4%. Colorado has been adding an average of 5,300 new jobs per month for the past year, and I anticipate that this growth rate will continue through the balance of 2018.

In February, the unemployment rate in Colorado was 3.0%—a level that has held steady for the past six months. Unemployment has dropped in all the markets contained in this report, with the lowest reported rates in Fort Collins and Denver, where 3.1% of the labor force was actively looking for work. The highest unemployment rate was in Grand Junction, which came in at 4.6%.

HOME SALES ACTIVITY

- In the first quarter of 2018, there were 11,173 home sales—a drop of 5.6% when compared to the first quarter of 2017.

- With an increase of 5.3%, home sales rose the fastest in Boulder County, as compared to first quarter of last year. There was also a modest sales increase of 1.2% in Larimer County. Sales fell in all the other counties contained within this report.

- Home sales continue to slow due to low inventory levels, which were down 5.7% compared to a year ago.

- The takeaway here is that sales growth continues to stagnate due to the lack of homes for sale.

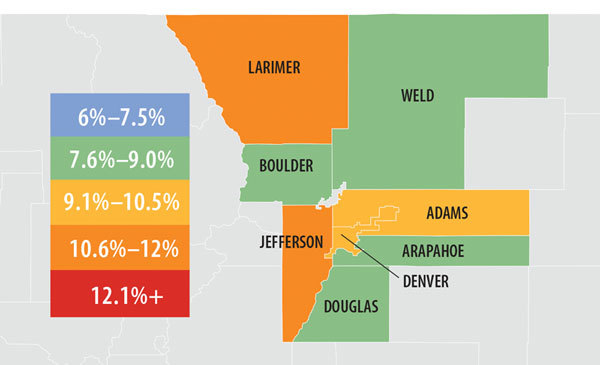

HOME PRICES

- Strong economic growth, combined with limited inventory, continued to push prices higher. The average home price in the markets covered by this report was up by 11.7% year-over-year to $448,687.

- Arapahoe County saw slower appreciation in home values, but the trend is still positiveand above its long-term average.

- Appreciation was strongest in Boulder County, which saw prices rise 14.8%. Almost all other counties in this report experienced solid gains.

- The ongoing imbalance between supply and demand persists and home prices continue to appreciate at above-average rates.

DAYS ON MARKET

- The average number of days it took to sell a home dropped by three days when compared to the first quarter of 2017.

- Homes in all but two counties contained in this report took less than a month to sell. Adams County continues to stand out where it took an average of just 17 days to sell a home.

- During the first quarter, it took an average of 27 days to sell a home. That rate is down 2 days from the fourth quarter of 2017.

- Housing demand remains strong and would-be buyers should expect to see stiff competition for well-positioned, well-priced homes.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. In the first quarter of 2018, I have left the needle where it was in the fourth quarter of last year. Even as interest rates trend higher, it appears as if demand will continue to outweigh supply. As we head into the spring months, I had hoped to see an increase in the number of homes for sale, but so far that has not happened. As a result, the housing market continues to heavily favor sellers.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. In the first quarter of 2018, I have left the needle where it was in the fourth quarter of last year. Even as interest rates trend higher, it appears as if demand will continue to outweigh supply. As we head into the spring months, I had hoped to see an increase in the number of homes for sale, but so far that has not happened. As a result, the housing market continues to heavily favor sellers.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Northern Colorado Market Forecast Overview

Did you miss our Northern Colorado real estate market forecast or do you just want a quick refresher?

Windermere Colorado’s President, Eric Thompson, gives you a recap of what we discussed and what we predict will happen with the housing market in the upcoming years.

A few key points from Matthew Gardner, co-presenter at the forecast and Windermere Real Estate’s very own Chief Economist:

OVERVIEW

Annual employment growth in Colorado was measured at a respectable 2.2% in November and will likely finish the year having created around 55,000 new jobs. Within the metropolitan market areas included in this report, we are seeing employment growth at or above the state level and I anticipate that this will continue to be the case in 2017.

Unemployment rates continue to drop, and with rates now below three percent, all of Colorado’s metro areas are at full employment. Because of this robust level of growth—in concert with very low unemployment levels—I anticipate that we will see some fairly substantial income growth as companies look to recruit new talent and keep existing employees happy.

HOME SALE ACTIVITY

- There were 14,614 home sales during the fourth quarter of 2016—up by a marginal 0.7% from the same period in 2015.

- Jefferson County saw sales grow at the fastest rate over the past 12 months, with a 5.9% increase. Sales activity fell in three counties, but this was a function of short supply rather than slowing demand.

- Listing activity continues to remain well below historic averages, with the total number of homes for sale in the fourth quarter 12.8% below that seen a year ago.

- The key takeaway from this data is that 2017 is shaping up to be one which will still substantially favor home sellers. I do anticipate that we will see some improvement in listing activity, but it is almost a certainty that demand will exceed supply for another year.

HOME PRICES

- Demand continued to exceed supply in the final three months of 2016 and this caused home prices to continue to rise. In the fourth quarter, average prices rose by 9% when compared to the fourth quarter of 2015. The average sales price across the region is now $393,969.

- In many parts of the region, prices are well above historic highs and continue to trend upward. With double-digit price increases over the past year, the market remains very hot.

- Annual price growth was strongest in Larimer and Jefferson Counties, where prices rose by 11.8% and 10.9% respectively.

- While we will likely see some modest softening in home price growth in 2017, we can still expect a very strong market.

Colorado Real Estate Market Update

ECONOMIC OVERVIEW

Annual employment growth in Colorado was measured at a respectable 2.2% in November and will likely finish the year having created around 55,000 new jobs. Within the metropolitan market areas included in this report, we are seeing employment growth at or above the state level and I anticipate that this will continue to be the case in 2017.

Unemployment rates continue to drop, and with rates now below three percent, all of Colorado’s metro areas are at full employment. Because of this robust level of growth—in concert with very low unemployment levels—I anticipate that we will see some fairly substantial income growth as companies look to recruit new talent and keep existing employees happy.

HOME SALE ACTIVITY

- There were 14,614 home sales during the fourth quarter of 2016—up by a marginal 0.7% from the same period in 2015.

- Jefferson County saw sales grow at the fastest rate over the past 12 months, with a 5.9% increase. Sales activity fell in three counties, but this was a function of short supply rather than slowing demand.

- Listing activity continues to remain well below historic averages, with the total number of homes for sale in the fourth quarter 12.8% below that seen a year ago.

- The key takeaway from this data is that 2017 is shaping up to be one which will still substantially favor home sellers. I do anticipate that we will see some improvement in listing activity, but it is almost a certainty that demand will exceed supply for another year.

HOME PRICES

- Demand continued to exceed supply in the final three months of 2016 and this caused home prices to continue to rise. In the fourth quarter, average prices rose by 9% when compared to the fourth quarter of 2015. The average sales price across the region is now $393,969.

- In many parts of the region, prices are well above historic highs and continue to trend upward. With double-digit price increases over the past year, the market remains very hot.

- Annual price growth was strongest in Larimer and Jefferson Counties, where prices rose by 11.8% and 10.9% respectively.

- While we will likely see some modest softening in home price growth in 2017, we can still expect a very strong market.

DAYS ON MARKET

- The average number of days it took to sell a home dropped by one day when compared to the fourth quarter of 2015.

- Homes in a majority of the counties took less than a month to sell.

- In the final quarter of the year, it took an average of just 27 days to sell a home. This is down from the 28 days it took in the fourth quarter of 2015.

- The Northern Colorado housing market is still firing on all cylinders. The only missing piece is listings, which remain well below the historic average.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economic factors.

For the fourth quarter of 2016, the needle remains firmly in the seller’s territory. It will be interesting to see if the recent increase in mortgage rates has any effect at all on the housing market. I believe that it will; however, I expect that it will likely cause a slowdown in home price growth rather than any collapse in home prices.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link