A History Lesson

One of the most common questions we hear from clients is “Where do you think interest rates are going?”

One of the most common questions we hear from clients is “Where do you think interest rates are going?”

Virtually all of the experts we follow put rates above 5% going into next year and some see rates approaching 5.5% by the middle of 2019. What’s certain is that there are economic forces at work that are pushing rates higher.

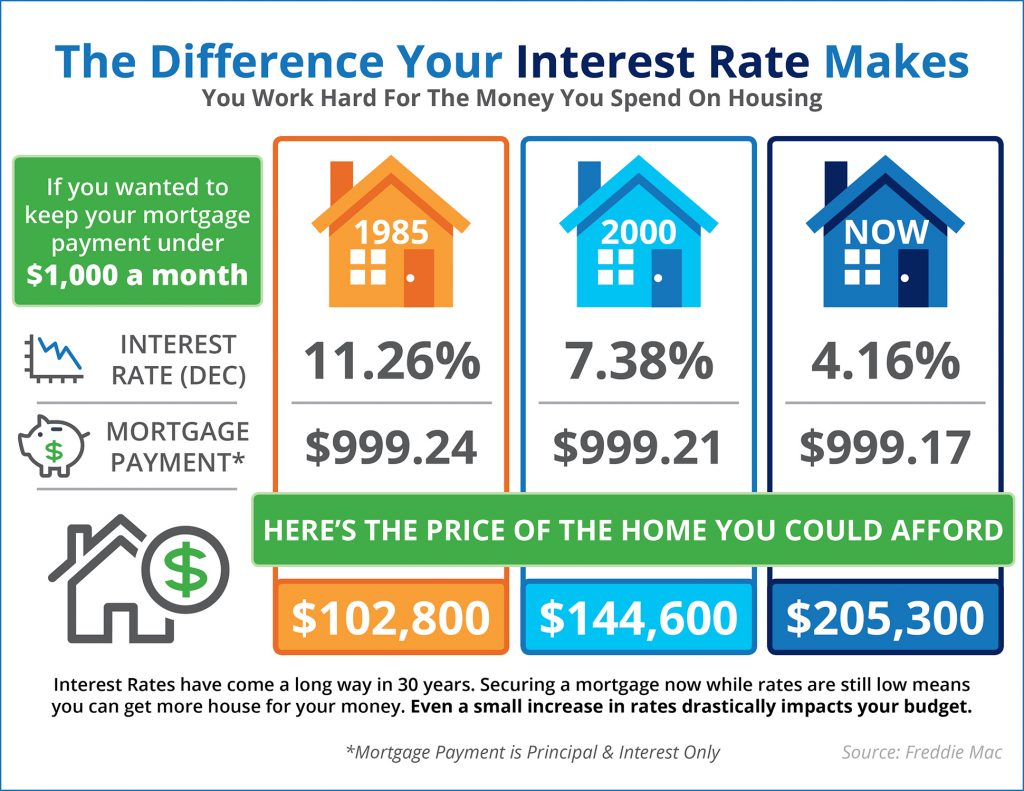

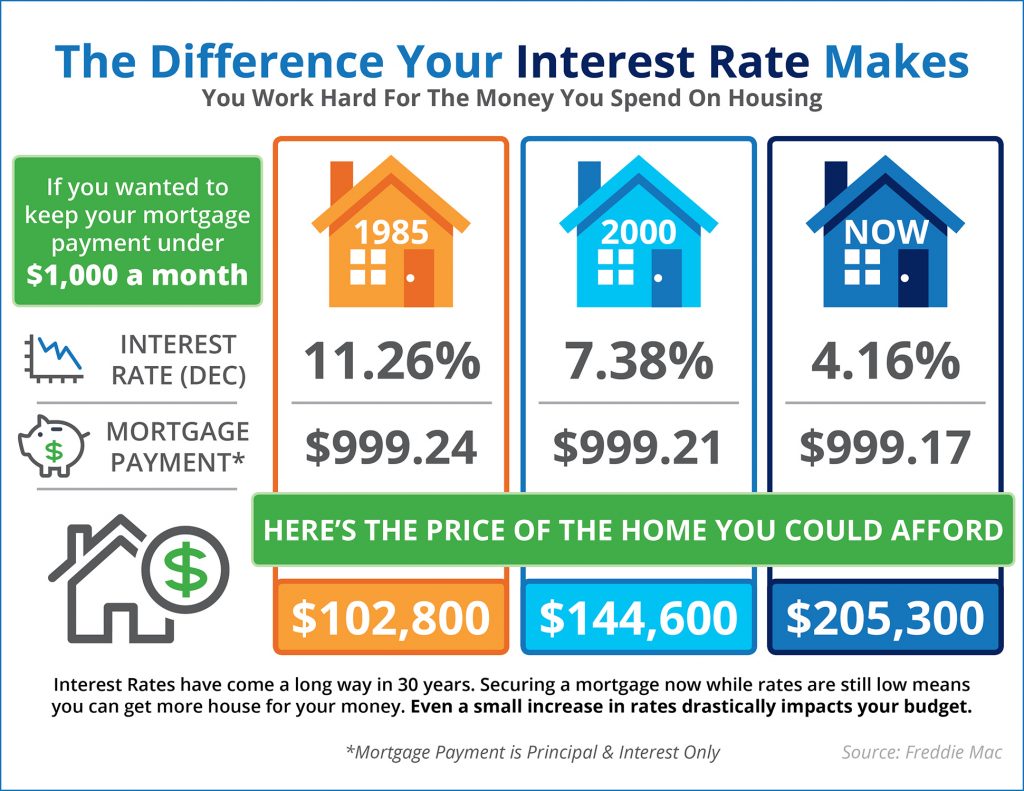

So, how about a little history lesson? How do today’s 30- year mortgage rates compare to this same date in history going all the way back to 1990?

• Today = 4.85%

• 2017 = 3.94%

• 2015 = 3.82%

• 2010 = 4.27%

• 2005 = 5.98%

• 2000 = 7.84%

• 1995 = 7.75%

• 1990 = 10.22%

While today’s rates feel high only because they are higher than 2017, they are quite a bit lower than at many times in history.

Limited Choices

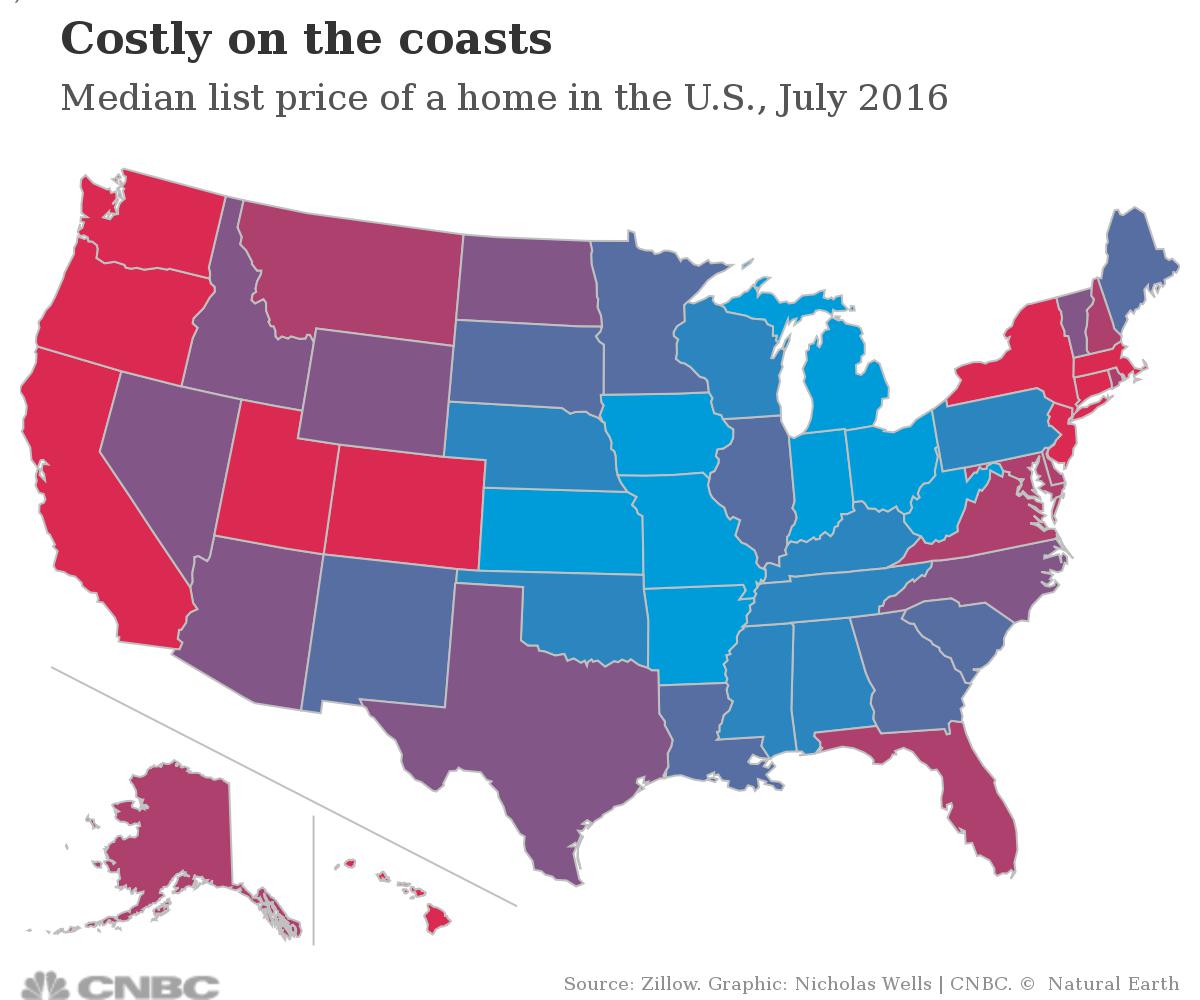

Pretend that customer walks into our office and tells us they are looking for a single family home in Fort Collins. We would tell them that there  are 314 to choose from. But if they told us their price range is up to $300,000, their choices would be limited to just 10 homes.

are 314 to choose from. But if they told us their price range is up to $300,000, their choices would be limited to just 10 homes.

Our Crystal Ball

Last week Windermere’s Chief Economist Matthew Gardner joined us for our annual Market Forecast events in Colorado. We were pleased to host over 500 customers at two events in Denver and Fort Collins.

host over 500 customers at two events in Denver and Fort Collins.

100K

The City Manager for Fort Collins, Darin Atteberry, recently visited our weekly sales meeting. He had several interesting and valuable facts to share, including this…

The Trump Tantrum

Since the election interest rates have jumped from 3.77% to 3.95% according to the Mortgage Bankers Association.

Since the election interest rates have jumped from 3.77% to 3.95% according to the Mortgage Bankers Association.

“This week’s increase in mortgage rates, being dubbed the ‘Trump Tantrum,’ is the biggest one week increase since the ‘Taper Tantrum‘ in June 2013,” said Bankrate’s chief financial analyst Greg McBride.

Economists say the anticipation of Trump’s pledged spending plans and tax cuts have investors anticipating some inflation and a dose of adrenaline to the economy which have caused a great deal of volatility in the market.

A little perspective is in order- rates today are still lower than the 3.97% recorded last year at this time. And, rates today are still essentially half of their long-term average.

Using a $400,000 home as an example with a 20% down payment, this interest rate increase translates to an additional $34 per month.

Many economists believe that we are now seeing the beginning of a long-term rise in interest rates.

source: Inman News

Beware of Low Down Payments

First-time buyers can borrow with little down, but that may not be wise

Financial planners warn: "Borrowers should not overlook the true measure of home affordability: monthly cash flow."

Is your down payment going to affect your cash flow in the end? Check out this article to see what they suggest.

http://www.cnbc.com/2016/09/02/homebuyers-beware-of-banks-offering-too-much-cash.html

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link