Are We Heading Towards A Bubble?

The US housing market has been going gangbusters in recent years. Record-setting sales, record-setting home prices, and a market that has largely favored sellers, while forcing fierce competition among buyers. All of this has led some to worry that we are heading towards another housing bubble. So, are we? On Tuesday, September 25, at 11 AM PST, Windermere Real Estate is hosting a Facebook Live event where our Chief Economist, Matthew Gardner, will discuss this and the latest Case-Shiller housing report. Whether you’re a buyer, seller, homeowner, or just a real estate junky, tune in to see what Matthew has to say; he’ll also be taking questions from the audience. This is the first in a series of Facebook Live events with Matthew, which will take place on the last Tuesday of each month.

You can learn more and offer suggestions for future discussions by following the link to the event here

5 Reasons Rising Interest Rates Won’t Wreck the Housing Market

Interest rates have been trending higher since the fall of 2017, and I fully expect they will continue in that direction – albeit relatively slowly – as we move through the balance of the year and into 2019. So what does this mean for the US housing market?

It might come as a surprise to learn that I really don’t think rising interest rates will have a major impact on the housing market. Here is my reasoning:

1. First Time Home Buyers

As interest rates rise, I expect more buyers to get off the fence and into the market; specifically, first time buyers who, according to Freddie Mac, made up nearly half of new mortgages in the first quarter of this year. First-time buyers are critical to the overall health of the housing market because of the subsequent chain reaction of sales that result so this is actually a positive outcome of rising rates.

2. Easing Credit Standards

Rising interest rates may actually push some lenders to modestly ease credit standards. I know this statement will cause some people to think that easing credit will immediately send us back to the days of sub-prime lending and housing bubbles, but I don’t see this happening. Even a very modest easing of credit will allow for more than one million new home buyers to qualify for a mortgage.

3. Low Unemployment

We stand today in a country with very low unemployment (currently 4.0% and likely to get close to 3.5% by year’s end). Low unemployment rates encourage employers to raise wages to keep existing talent, as well as to recruit new talent. Wage growth can, to a degree, offset increasing interest rates because, as wages rise, buyers can afford higher mortgage payments.

4. Supply

There is a clear relationship between housing supply, home prices, and interest rates. We’re already seeing a shift in inventory levels with more homes coming on the market, and I fully expect this trend to continue for the foreseeable future. This increase in supply is, in part, a result of homeowners looking to cash in on their home’s appreciation before interest rates rise too far. This, on its own, will help ease the growth of home prices and offset rising interest rates. Furthermore, if we start to see more new construction activity at the lower end of the market, this too will help.

National versus Local

Up until this point, I’ve looked at how rising interest rates might impact the housing market on a national level, but as we all know, real estate is local, and different markets react to shifts in different ways. For example, rising interest rates will be felt more in expensive housing markets, such as San Francisco, New York, Los Angeles, and Orange County, but I expect to see less impact in areas like Cleveland, Philadelphia, Pittsburg, and Detroit, where buyers spend a lower percentage of their incomes on housing. The exception to this would be if interest rates continue to rise for a prolonged period; in that case, we might see demand start to taper off, especially in the less expensive housing markets where buyers are more price sensitive.

For more than seven years, home buyers and real estate professionals alike have grown very accustomed to historically low interest rates. We always knew the time would come when they would begin to rise again, but that doesn’t mean the outlook for housing is doom and gloom. On the contrary, I believe rising interest rates will help bring us closer to a more balanced real estate market, something that is sorely needed in many markets across the country.

How Restrictive Growth Policies Affect Housing Affordability In Many Cities

Windermere Real Estate Chief Economist Matthew Gardner explains how restrictive growth policies are affecting housing affordability in many cities.

How Will the Real Estate Market Respond to Rising Interest Rates?

Let Windermere Real Estate’s Chief Economist Matthew Gardner walk you through what to expect from the real estate market amidst rising interest rates.

Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market (which now includes Clear Creek, Gilpin, and Park Counties) is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Colorado continues to see very strong job growth, adding 72,800 non-agricultural jobs over the past 12 months—an impressive increase of 2.7%. Through the first five months of 2018, the state added an average of 7,300 new jobs per month. I expect this growth to continue through the remainder of the year, resulting in about 80,000 new jobs in 2018.

In May, the state unemployment rate was 2.8%. This is slightly above the 2.6% we saw a year ago but still represents a remarkably low level. Unemployment remains either stable or is dropping in all the markets contained in this report, with the lowest reported rates in Fort Collins and Boulder, where just 2.2% of the labor force was actively looking for work. The highest unemployment rate was in Grand Junction, which came in at 3.1%.

HOME SALES ACTIVITY

- In the second quarter of 2018, 17,769 homes sold—a drop of 2.4% compared to the second quarter of 2017.

- Sales rose in 5 of the 11 counties contained in this report, with Gilpin County sales rising by an impressive 10.7% compared to second quarter of last year. There were also noticeable increases in Clear Creek and Weld Counties. Sales fell the most in Park County but, as this is a relatively small area, I see no great cause for concern at this time.

- Slowing sales activity is to be expected given the low levels of available homes for sale in many of the counties contained in this report. That said, we did see some significant increases in listing activity in Denver and Larimer Counties. This should translate into increasing sales through the summer months.

- The takeaway here is that sales growth is being hobbled by a general lack of homes for sale, and due to a drop in housing demand.

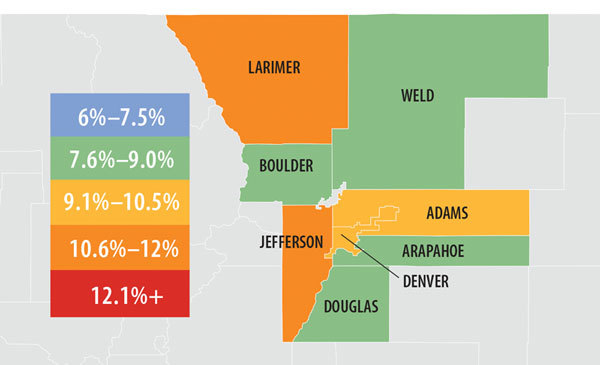

HOME PRICES

- With strong economic growth and a persistent lack of inventory, prices continue to trend higher. The average home price in the region rose

9.8% year-over-year to $479,943. - The smallest price gains in the region were in Park County, though the increase there was still a respectable 7%.

- Appreciation was strongest in Clear Creek and Gilpin Counties, where prices rose by 28.9% and 26%, respectively. All other counties in this report saw gains above the long-term average.

- Although there was some growth in listings, the ongoing imbalance between supply and demand persists, driving home prices higher.

DAYS ON MARKET

- The average number of days it took to sell a home remained at the same level as a year ago.

- The length of time it took to sell a home dropped in most markets contained in this report. Gilpin County saw a very significant jump in days on market, but this can be attributed to the fact that it is a very small area which makes it prone to severe swings.

- In the second quarter of 2018, it took an average of 24 days to sell a home. Of note is Adams County, where it took an average of only 10 days to sell a home.

- Housing demand remains very strong and all the markets in this report continue to be in dire need of additional inventory to satisfy demand.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

For the second quarter of 2018, I have moved the needle very slightly towards buyers as a few counties actually saw inventories rise. However, while I expect to see listings increase in the coming months, for now, the housing market continues to heavily favor sellers.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Should You Wait out the Housing Market?

The housing market is remarkably tight across the U.S., and you may be wondering if you should wait for home prices to slow before making your move. Windermere’s Chief Economist, Matthew Gardner, shares why waiting could end up costing you more money in the long run.

Northern Colorado Market Forecast Overview

Did you miss our Northern Colorado real estate market forecast or do you just want a quick refresher?

Windermere Colorado’s President, Eric Thompson, gives you a recap of what we discussed and what we predict will happen with the housing market in the upcoming years.

A few key points from Matthew Gardner, co-presenter at the forecast and Windermere Real Estate’s very own Chief Economist:

OVERVIEW

Annual employment growth in Colorado was measured at a respectable 2.2% in November and will likely finish the year having created around 55,000 new jobs. Within the metropolitan market areas included in this report, we are seeing employment growth at or above the state level and I anticipate that this will continue to be the case in 2017.

Unemployment rates continue to drop, and with rates now below three percent, all of Colorado’s metro areas are at full employment. Because of this robust level of growth—in concert with very low unemployment levels—I anticipate that we will see some fairly substantial income growth as companies look to recruit new talent and keep existing employees happy.

HOME SALE ACTIVITY

- There were 14,614 home sales during the fourth quarter of 2016—up by a marginal 0.7% from the same period in 2015.

- Jefferson County saw sales grow at the fastest rate over the past 12 months, with a 5.9% increase. Sales activity fell in three counties, but this was a function of short supply rather than slowing demand.

- Listing activity continues to remain well below historic averages, with the total number of homes for sale in the fourth quarter 12.8% below that seen a year ago.

- The key takeaway from this data is that 2017 is shaping up to be one which will still substantially favor home sellers. I do anticipate that we will see some improvement in listing activity, but it is almost a certainty that demand will exceed supply for another year.

HOME PRICES

- Demand continued to exceed supply in the final three months of 2016 and this caused home prices to continue to rise. In the fourth quarter, average prices rose by 9% when compared to the fourth quarter of 2015. The average sales price across the region is now $393,969.

- In many parts of the region, prices are well above historic highs and continue to trend upward. With double-digit price increases over the past year, the market remains very hot.

- Annual price growth was strongest in Larimer and Jefferson Counties, where prices rose by 11.8% and 10.9% respectively.

- While we will likely see some modest softening in home price growth in 2017, we can still expect a very strong market.

Colorado Real Estate Market Update

ECONOMIC OVERVIEW

Annual employment growth in Colorado was measured at a respectable 2.2% in November and will likely finish the year having created around 55,000 new jobs. Within the metropolitan market areas included in this report, we are seeing employment growth at or above the state level and I anticipate that this will continue to be the case in 2017.

Unemployment rates continue to drop, and with rates now below three percent, all of Colorado’s metro areas are at full employment. Because of this robust level of growth—in concert with very low unemployment levels—I anticipate that we will see some fairly substantial income growth as companies look to recruit new talent and keep existing employees happy.

HOME SALE ACTIVITY

- There were 14,614 home sales during the fourth quarter of 2016—up by a marginal 0.7% from the same period in 2015.

- Jefferson County saw sales grow at the fastest rate over the past 12 months, with a 5.9% increase. Sales activity fell in three counties, but this was a function of short supply rather than slowing demand.

- Listing activity continues to remain well below historic averages, with the total number of homes for sale in the fourth quarter 12.8% below that seen a year ago.

- The key takeaway from this data is that 2017 is shaping up to be one which will still substantially favor home sellers. I do anticipate that we will see some improvement in listing activity, but it is almost a certainty that demand will exceed supply for another year.

HOME PRICES

- Demand continued to exceed supply in the final three months of 2016 and this caused home prices to continue to rise. In the fourth quarter, average prices rose by 9% when compared to the fourth quarter of 2015. The average sales price across the region is now $393,969.

- In many parts of the region, prices are well above historic highs and continue to trend upward. With double-digit price increases over the past year, the market remains very hot.

- Annual price growth was strongest in Larimer and Jefferson Counties, where prices rose by 11.8% and 10.9% respectively.

- While we will likely see some modest softening in home price growth in 2017, we can still expect a very strong market.

DAYS ON MARKET

- The average number of days it took to sell a home dropped by one day when compared to the fourth quarter of 2015.

- Homes in a majority of the counties took less than a month to sell.

- In the final quarter of the year, it took an average of just 27 days to sell a home. This is down from the 28 days it took in the fourth quarter of 2015.

- The Northern Colorado housing market is still firing on all cylinders. The only missing piece is listings, which remain well below the historic average.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economic factors.

For the fourth quarter of 2016, the needle remains firmly in the seller’s territory. It will be interesting to see if the recent increase in mortgage rates has any effect at all on the housing market. I believe that it will; however, I expect that it will likely cause a slowdown in home price growth rather than any collapse in home prices.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Limited Choices

Pretend that customer walks into our office and tells us they are looking for a single family home in Fort Collins. We would tell them that there  are 314 to choose from. But if they told us their price range is up to $300,000, their choices would be limited to just 10 homes.

are 314 to choose from. But if they told us their price range is up to $300,000, their choices would be limited to just 10 homes.

Our Crystal Ball

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link