Colorado Real Estate Market Update

ECONOMIC OVERVIEW

Annual employment growth in Colorado was measured at a respectable 2.2% in November and will likely finish the year having created around 55,000 new jobs. Within the metropolitan market areas included in this report, we are seeing employment growth at or above the state level and I anticipate that this will continue to be the case in 2017.

Unemployment rates continue to drop, and with rates now below three percent, all of Colorado’s metro areas are at full employment. Because of this robust level of growth—in concert with very low unemployment levels—I anticipate that we will see some fairly substantial income growth as companies look to recruit new talent and keep existing employees happy.

HOME SALE ACTIVITY

- There were 14,614 home sales during the fourth quarter of 2016—up by a marginal 0.7% from the same period in 2015.

- Jefferson County saw sales grow at the fastest rate over the past 12 months, with a 5.9% increase. Sales activity fell in three counties, but this was a function of short supply rather than slowing demand.

- Listing activity continues to remain well below historic averages, with the total number of homes for sale in the fourth quarter 12.8% below that seen a year ago.

- The key takeaway from this data is that 2017 is shaping up to be one which will still substantially favor home sellers. I do anticipate that we will see some improvement in listing activity, but it is almost a certainty that demand will exceed supply for another year.

HOME PRICES

- Demand continued to exceed supply in the final three months of 2016 and this caused home prices to continue to rise. In the fourth quarter, average prices rose by 9% when compared to the fourth quarter of 2015. The average sales price across the region is now $393,969.

- In many parts of the region, prices are well above historic highs and continue to trend upward. With double-digit price increases over the past year, the market remains very hot.

- Annual price growth was strongest in Larimer and Jefferson Counties, where prices rose by 11.8% and 10.9% respectively.

- While we will likely see some modest softening in home price growth in 2017, we can still expect a very strong market.

DAYS ON MARKET

- The average number of days it took to sell a home dropped by one day when compared to the fourth quarter of 2015.

- Homes in a majority of the counties took less than a month to sell.

- In the final quarter of the year, it took an average of just 27 days to sell a home. This is down from the 28 days it took in the fourth quarter of 2015.

- The Northern Colorado housing market is still firing on all cylinders. The only missing piece is listings, which remain well below the historic average.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economic factors.

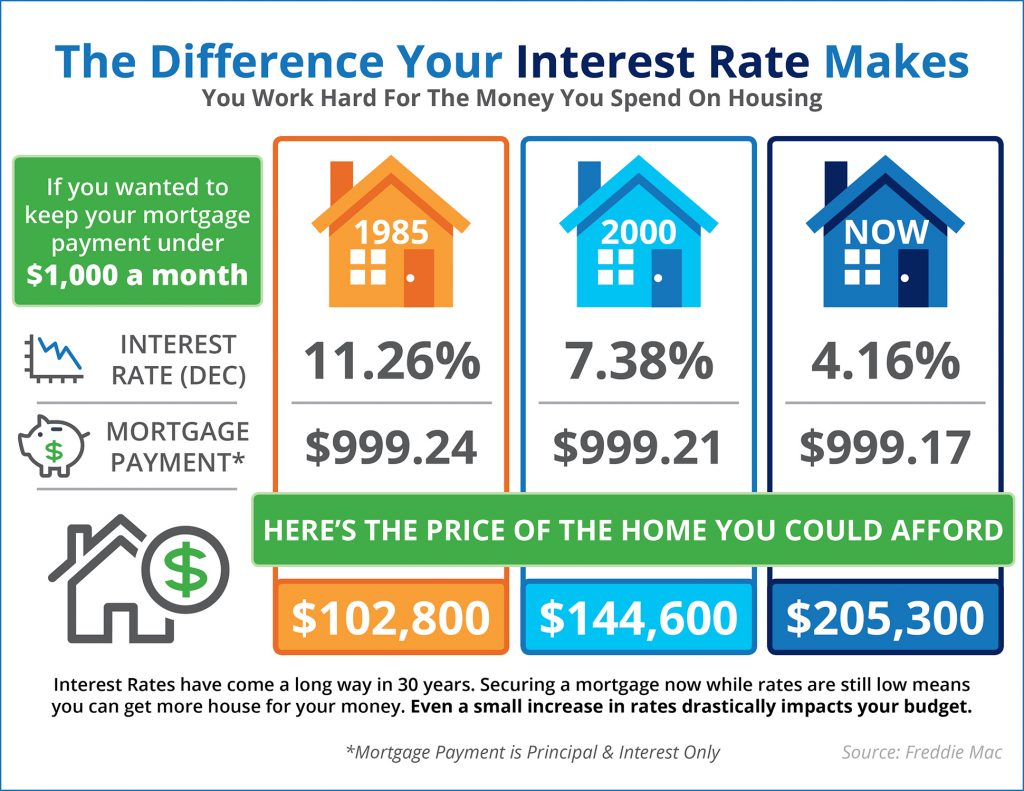

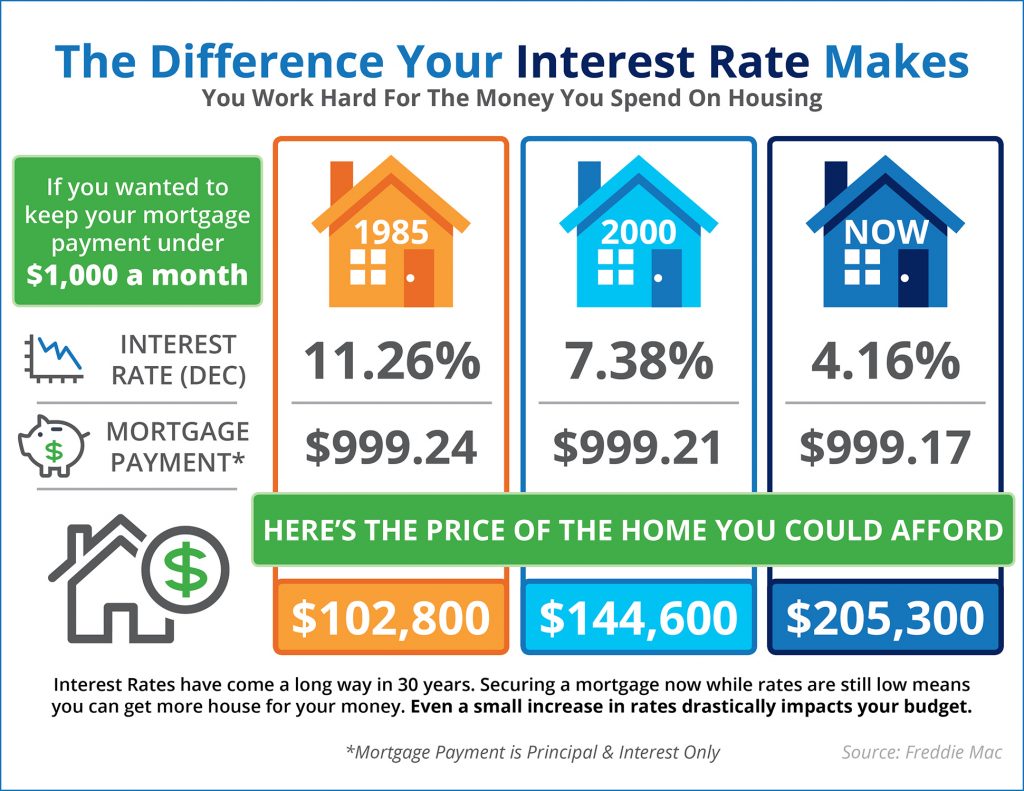

For the fourth quarter of 2016, the needle remains firmly in the seller’s territory. It will be interesting to see if the recent increase in mortgage rates has any effect at all on the housing market. I believe that it will; however, I expect that it will likely cause a slowdown in home price growth rather than any collapse in home prices.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Limited Choices

Pretend that customer walks into our office and tells us they are looking for a single family home in Fort Collins. We would tell them that there  are 314 to choose from. But if they told us their price range is up to $300,000, their choices would be limited to just 10 homes.

are 314 to choose from. But if they told us their price range is up to $300,000, their choices would be limited to just 10 homes.

Our Crystal Ball

Last week Windermere’s Chief Economist Matthew Gardner joined us for our annual Market Forecast events in Colorado. We were pleased to host over 500 customers at two events in Denver and Fort Collins.

host over 500 customers at two events in Denver and Fort Collins.

Wait or Buy Now?

Are you thinking about buying a new home in the next 5 years?

Studies show that if you wait, you could be paying substantially more. Check out this article by Keeping Current Matters that explains why buying a home this winter could be your smartest move. http://www.keepingcurrentmatters.com/4-reasons

Did You Know?

Here are some fun “Did You Know?” stats as we wrap up 2016 (arguably one of the most fascinating years in the history of Northern Colorado Real Estate)

Here are some fun “Did You Know?” stats as we wrap up 2016 (arguably one of the most fascinating years in the history of Northern Colorado Real Estate)

‘Tis the season to give!

Please consider giving a gift that counts this season.

Please consider giving a gift that counts this season.

Donate to help those in need in Colorado. Just click the link below… ALL donations will go to one of three organizations in Colorado that benefit low-income and homeless children and families.

Merry Christmas! #TackleHomelessness

To donate, just click here to go to our secure donation site: https://store.windermere.com/content/colorado-tacklehomelessness-donation

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link