Matthew Gardner’s 2020 Real Estate Forecast

It’s that time of year when Windermere’s Chief Economist Matthew Gardner dusts off his crystal ball and peers into the future to give us his predictions for the 2020 economy and housing market.

Windermere Living Fall Issue

Dear Readers,

Welcome to the fall issue of Windermere Living! Are you a foodie who loves to travel? Inside this issue is an article about interesting destinations where you can enjoy edible, immersive experiences like making your own coffee on the Kona coast of Hawaii, or diving for clams in Cabo and cooking them with an executive chef.

If you’ve ever undergone a major home remodel, you know all too well how important it is to partner with the right architect. We explore that topic in this issue, along with some pro tips on how to match yourself up with the perfect architect for your project, a process that isn’t that different from dating.

Last but not least, there are more than 70 pages filled with homes for sale throughout the Western U.S. Whether you’re in the market for a country farmhouse or a high-rise condo, there’s a little something for everyone.

This is just a sampling of what you’ll find in this issue of Windermere Living; we hope you enjoy it!

Mortgage Rate Forecast

Geopolitical uncertainty is causing mortgage rates to drop. Windermere Chief Economist, Matthew Gardner, explains why this is and what you can expect to see mortgage rates do in the coming year.

Over the past few months we’ve seen a fairly significant drop in mortgage rates that has been essentially driven by geopolitical uncertainty – mainly caused by the trade war with China and ongoing discussions over tariffs with Mexico.

Now, mortgage rates are based on yields on 10-Year treasuries, and the interest rate on bonds tends to drop during times of economic uncertainty. When this occurs, mortgage rates also drop.

My current forecast model predicts that average 30-year mortgage rates will end 2019 at around 4.4%, and by the end of 2020 I expect to see the average 30-year rate just modestly higher at 4.6%.

Colorado Real Estate Market Update

Posted in Colorado Real Estate Market Update by Matthew Gardner, Chief Economist, Windermere Real Estate

The following analysis of the Metro Denver & Northern Colorado real estate market (which now includes Clear Creek, Gilpin, and Park counties) is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Colorado’s economy continues to grow with the addition of 44,800 new non-agricultural jobs over the past 12 months. This represents a reasonable growth rate of 1.7%. As stated in last quarter’s Gardner Report, we continue to see a modest slowdown in employment gains, but that’s to be expected at this stage of the business cycle. I predict that employment growth in Colorado will pick back up as we move through the year, adding a total of 70,000 new jobs in 2019, which represents a growth rate of 2.6%.

In February, the state unemployment rate was 3.7%, up from 2.9% a year ago. The increase is essentially due to labor force growth, which rose by more than 84,000 people over the past year. On a seasonally adjusted basis, unemployment rates in all the markets contained in this report haven’t moved much in the past year, but Boulder saw a modest drop (2.7%), and the balance of the state either remained at the same level as a year ago or rose very modestly.

HOME SALES

- In the first quarter of 2019, 11,164 homes sold — a drop of 3% compared to the first quarter of 2018 and down 13.5% from the fourth quarter of last year. Pending sales in the quarter were a mixed bag. Five counties saw an increase, but five showed signs of slowing.

- The only market that had sales growth was Adams, which rose 4.9%. The rest of the counties contained in this report saw sales decline, with a significant drop in the small Park County area.

- I believe the drop in the number of home sales is partially due to the significant increase in listings (+45.6%), which has given would-be home buyers more choice and less need to act quickly.

- As mentioned above, inventory growth in the quarter was significant, but I continue to believe that the market will see sales rise. I expect the second half of the year to perform better than the first.

HOME PRICES

Home prices continue to trend higher, but the rate of growth is tapering. The average home price in the region rose just 2.1% year-over-year to $456,243. Home prices were .3% higher than in the fourth quarter of 2018.

Home prices continue to trend higher, but the rate of growth is tapering. The average home price in the region rose just 2.1% year-over-year to $456,243. Home prices were .3% higher than in the fourth quarter of 2018.- I anticipate that the drop in interest rates early in the year will likely get more buyers off the fence and this will allow prices to rise.

- Appreciation was again strongest in Park County, where prices rose 21.9%. We still attribute this rapid increase to it being a small market. Only Clear Creek County experienced a drop in average home price. Similar to Park County, this is due to it being a very small market, making it more prone to significant swings.

- Affordability remains an issue in many Colorado markets but that may be offset by the drop in interest rates.

DAYS ON MARKET

- The average number of days it took to sell a home in Colorado rose five days compared to the first quarter of 2018.

- The amount of time it took to sell a home dropped in two counties — Gilpin and Park — compared to the first quarter of 2018. The rest of the counties in this report saw days-on-market rise modestly with the exception of the small Clear Creek market, which rose by 26 days.

- In the first quarter of 2019, it took an average of 42 days to sell a home in the region, an increase of four days compared to the final quarter of 2018.

- Job growth drives housing demand, but buyers are faced with more choice and are far less frantic than they were over the past few years. That said, I anticipate the late spring will bring more activity and sales.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

For the first quarter of 2019, I have moved the needle a little more in favor of buyers. I am watching listing activity closely to see if we get any major bumps above the traditional increase because that may further slow home price growth; however, the trend for 2019 will continue towards a more balanced market.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

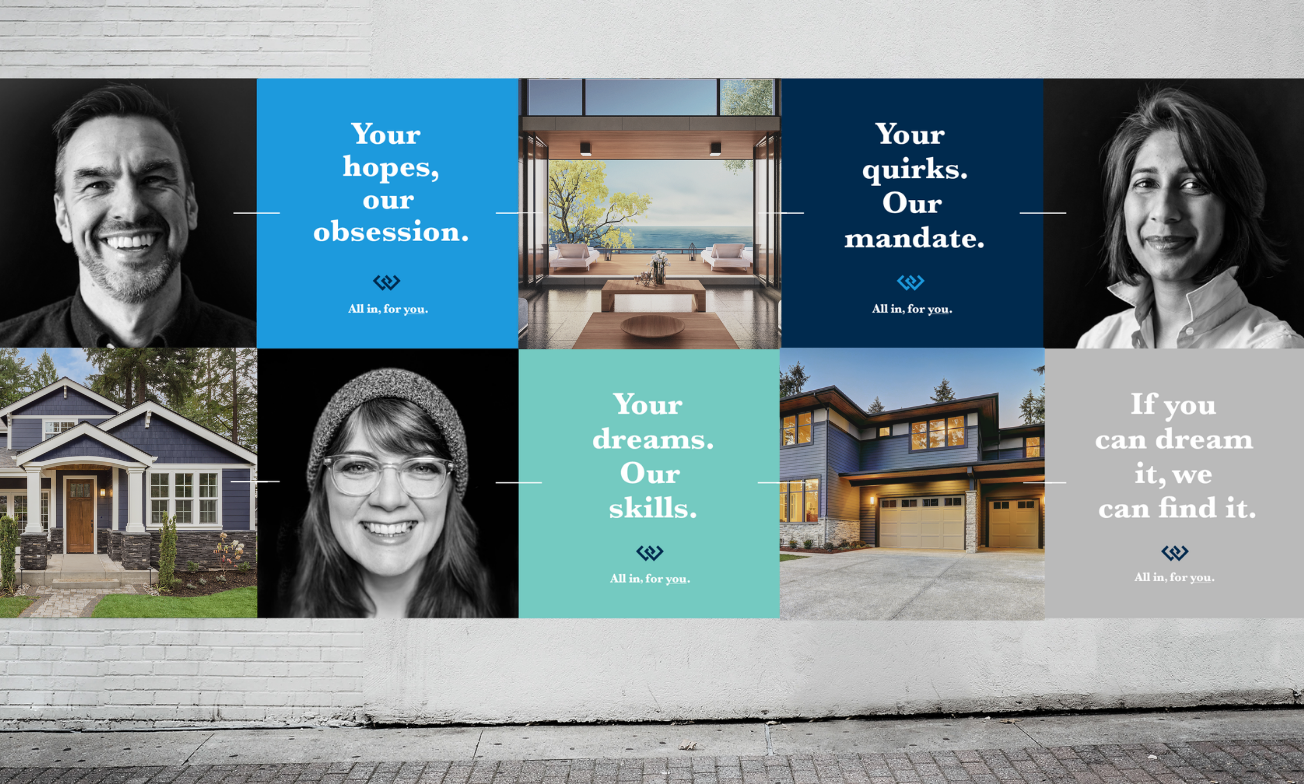

Windermere Launches “All in, for you” Branding Campaign

Posted in Windermere by Shelley Rossi

Windermere Real Estate has officially launched a new branding campaign on the heels of the company’s brand refresh that was completed in 2018. The “All in, for you” campaign is the next step in bringing the refreshed Windermere brand to life by amplifying the company’s unique “why”.

Told, in part, through stories generated by actual Windermere agents, the “All in, for you” campaign sets out to illustrate Windermere’s unique culture, and what has drawn both agents and clients to it for nearly 50 years.

“We’re lucky to have a brand with such a rich legacy, but we have to continue to innovate and press forward,” said Windermere president, OB Jacobi. “The brand refresh that we did last year was part one of Windermere’s brand story; part two is about bringing our stories to life and showing our clients how we’re ‘all in’, for them.”

Development of the “All in, for you” campaign was led by Windermere Vice President of Marketing, Julie Dey, and Portland, OR-based global design firm, Ziba Design, whose clients include companies, such as FedEx, P&G, Adidas, REI, and Intel. Ziba started the year-long process by conducting interviews and holding focus groups with Windermere agents, franchise owners, and staff. They also interviewed past buyers and sellers to better understand the experience of working with a Windermere agent.

“We needed to speak directly with consumers to understand what people want, where real estate is headed, and the differentiated value that Windermere agents provide,” said Rob Wees, Creative Director at Ziba, adding, “Real estate is an infrequent, emotional, and complicated process. And every experience is so different.”

“In an era of technology and convenience, we wanted to show the public the real value of working with a Windermere agent—one that shows how compassion, expertise, advocacy and an over-commitment to service can help people through an incredibly important moment in their lives,” said Wees.

Components of the “All in, for you” campaign include TV, print, digital marketing, out-of-home advertising, and partnerships with key media companies to create unique content opportunities. To kick-off the campaign, TV ads will begin running March 21 in the Seattle market.

“While some real estate companies are telling what is essentially a technology story about ones and zeroes, our story is more about connecting humans with their dreams. And it’s a story we can’t wait to tell,” said Dey.

How to Create a More Beautiful and “Sale” Ready Home

When you love your home but want to make some changes, how do you know where to begin? As a real estate broker and advisor to my clients, I am often asked what improvement projects are most worthwhile or where money is best invested.

In today’s market, I am consistently seeing that buyers are looking for the “cream puff” listings. They want a home that is well maintained, “move in” ready, priced well, and in a good location. No surprise there, right?

In today’s market, I am consistently seeing that buyers are looking for the “cream puff” listings. They want a home that is well maintained, “move in” ready, priced well, and in a good location. No surprise there, right?

As I work with clients, whether they are preparing to move now or just looking to improve their home for their own enjoyment, I find a few things that consistently show rewards in the end.

Beginning with maintenance items such as roofing, siding, paint (both interior and exterior), windows, and a couple secret weapons that are often overlooked, which offer a huge impact and are more reasonably priced than you may think, are new garage doors and outdoor fixtures. Remember you never get a second chance to make a first impression!

Outdoor living areas have become all the rage by giving the homeowner an opportunity to add additional entertaining space to their home. The options here are endless depending on your budget and amount of space you have to work with, but this can be a great way to improve the function and finish of your home.

Take a minute to ask yourself, where do I spend most of my time in my home? Kitchen, kitchen, kitchen! We all love to eat and hang out in the kitchen. As a result, improvements here are always a good place to start.

Owner’s bedroom suites and bathrooms are also very popular areas for improvement. The range of options for these areas is vast based again on size and budget.

Consider replacing hard surfaces, base and trim, fixtures, and doors. Think outside the box and ask an expert for help choosing something that might set your home apart. Why use the same six-panel door that everyone has? Change it up a bit. Starting with the solid bones using neutral tones and embellishing with accessories to add a splash of color and your own flair is always a winner!

The more open, clean, and well maintained your home is, the greater your return on your investment will be. Buyers in today’s market have access to an abundance of information and have a good eye for short cuts. Work done just to “flip” a home will be called out very quickly! Always ask a professional for advice. You will find your favorite contractor or real estate professional will be more than happy to spend some time helping you make educated decisions that will meet your needs and show long term return.

By Aimee Shriner

By Aimee Shriner

Windermere Real Estate/Northeast Inc.

Kirkland, WA

Orignially posted on RGN Construction’s blog.

All photos are from www.rgncon.com

Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market (which now includes Clear Creek, Gilpin, and Park Counties) is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

The Colorado economy continues to grow, adding 69,100 new non-agricultural jobs over the past 12 months, which represents a solid growth rate of 2.6%. That said, we are continuing to see a modest slowdown in employment gains, but that is to be expected at this stage of the business cycle. My latest forecast suggests that Colorado will add a total of 65,000 new jobs in 2019, representing a growth rate of 2.3%.

In November, the state unemployment rate was 3.3%, up from 3% a year ago. The increase is essentially due to an increase in the labor force, which rose by 77,279 people. On an un-seasonally adjusted basis, unemployment rates in all the markets contained in this report dropped between November 2017 and November 2018. The highest rate was in Grand Junction, but that was still a very respectable 4%. Fort Collins and Boulder had the lowest unemployment rate of 2.9%. All the regions contained in this report are essentially at full employment.

HOME SALES ACTIVITY

- In the fourth quarter of 2018, 12,911 homes sold — a drop of 13.8% compared to the last quarter of 2017 and down 22% from the third quarter.

- The only market that saw growth in sales was Clear Creek, which rose by 3.8%. This is a small market, however, and is prone to rapid swings in price as well as sales. There was a significant drop in sales in the Denver market. I will be watching closely to see if this is an anomaly or a longer-term trend. At this time, I believe the former to be true.

- Interestingly, this decline in sales in Denver came as inventory levels rose by 37%. For now, I attribute this to seasonality and expect to see sales growth return in the spring.

- Inventory growth continues to give buyers more choice, allowing them to be far more selective — and patient — before making an offer on a home. That said, well-positioned and well-priced homes are selling relatively quickly.

HOME PRICES

- Despite the rapid rise in listings and slowing home sales, prices continue to trend higher, though the rate of growth is slowing. The average home price in the region rose 6% year-over-year to $454,903. Home prices were 2% higher than in the third quarter.

- In all, the data was not very surprising. As with many markets across the country, affordability is starting to become an issue. However, the recent drop in interest rates likely stimulated buyers at the end of 2018 and I expect to see good price growth in the first quarter of 2019.

- Appreciation was strongest in Park County, where prices rose 28.2%. We can attribute this rapid increase to it being a small market. Only Gilpin County saw a drop in average home price. Though this, too, is due to it being a very small market, making it more prone to significant swings.

- As mentioned, affordability is becoming an issue in many Colorado markets and I anticipate that we will see some cooling in home price appreciation as we move through late 2019.

DAYS ON MARKET

- The average number of days it took to sell a home in Colorado rose by one day compared to the final quarter of 2017.

- The amount of time it took to sell a home dropped in four counties: Boulder, Larimer, Gilpin, and Park. The rest of the counties in this report saw days on market rise relatively modestly with the exception of the small Clear Creek market, which rose by 20 days.

- In the fourth quarter of 2018, it took an average of 38 days to sell a home in the region, but it took less than a month to sell a home in five of the eleven counties contained in this report.

- Housing demand is still there, but buyers appear to have taken a little breather. I anticipate, however, that the spring will bring more activity and rising sales.

CONCLUSIONS

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

For the fourth quarter of 2018, I continue the trend I started last summer and have moved the needle a little more in favor of buyers. I will be closely watching listing activity in the spring to see if we get any major bumps above the traditional increase because that may further slow home price growth — something that would-be buyers appear to be waiting for.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governor’s Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Beautiful Inside & Out – Timber Interiors for a Timber Frame Home

A home that exudes beauty from the inside and the outside is also a true reflection of its owner. Today, homes are not just mere living spaces that are filled up with furniture – every home has a character, design theme, and personality of its own, characterized largely by the material used to build it, the color scheme on the inside and outside, and also the accents and hues of every element that goes into it.

One such building material is Timber, which truly brings out the class and beauty in a home. Timber frame houses have many positive attributes to them and are rightfully becoming one of the most popular choices for home building material. Let’s look at some of the pros of using timber for your home:

- Look and feel

Timber is one of the classiest looking building materials, with a sleek finish and a light but sturdy build. Timber, being a natural material, also has a natural feel to it, of course without compromising on reliability. Timber both on the inside and the outside looks amazing and is also quite easy to work with in terms of designing and color palettes. Timber comes in a number of finishes and colors. You could go for a smooth and sleek finish it even a textured look for a more rustic feel. There’s also distressed timber which gives a home a vintage and retro look and comes in a darker shade.

- Heat and cold

Timber framing and construction allows you to enjoy the benefits of its insulating properties. Not just that, it also retains heat and maintains a conducive temperature and atmosphere inside the home. Timber is one of those materials that would sustain you in both hot and cold climatic conditions, and you wouldn’t have to spend too much on HVAC solutions either.

- Longevity and ease of use

Timber is surely one of the most durable materials for constructing a home, especially the new age timber frames which go through special treatment to make the material is stronger, more resistant and also durable. The best part is that timber is also such an easy and convenient material to work with. The build time for a timber frame home is significantly lesser than most other traditional materials. Erecting a timber frame home can be done with ease, and it also does not require any extensive concrete footings, hence the quickness of construction.

- Versatility outdoors and indoors

There are umpteen options for you to choose from, where timber can be used to add-on to the beauty of your home both internally and externally. Outdoor kitchens, pergolas, gazebos, picnic shelters, covered decks, bridges and so much more can be done to the external area of your home.

For the interiors as well, timber can be used for frame accents, staircases, and beautiful railings, and complete timber frame kits and packages come with everything you’d need, including door, window, roof and wall enclosure systems that provide the support your timber frame home needs. Imagine a spacious timber frame home with an open, gourmet kitchen and a dramatic winding staircase? Or even floor to ceiling windows that allow ample natural light to encompass the home. All of this and more is very much possible with timber as the main material.

- Space utilization

Want to make the most of every inch of space you have for your home? Timber framing is one of the best ways to do this! A timber frame floor plan is so flexible and dynamic, and you can add absolutely anything you want, as long as you include it into the final plan. Want to add an extra room? Opt for bigger doors and windows? Or maybe use the extra roof space to create a handy loft? All of this and more is quite easy to do with a timber frame home, and that’s what makes your home uniquely yours in both design and functionality.

Bottom Line

Costs are usually a concern while building a new home or re-doing an existing one, but timber is one material that gives you total value for the money you spend. A regular brick and mortar home is expensive as is and doesn’t provide you with any additional benefits. Timber, on the other hand, gives you all the above-mentioned benefits and more, so in terms of cost to value ratio, is a much smarter and more sensible option to go for. So, to create a uniform look and feel both inside and outside, timber is the ideal material to bring out the true beauty of your abode!

Our Guest Author is Tyler of Hamill Creek Timber Homes.

Is a “home exchange” vacation right for you?

It is finally summer; time for barbecues, summer camp, and family vacations. In recent years we’ve heard of people shortening their vacations, staying closer to home, or going nowhere at all for “staycations”. Another way to save money, while still getting away, is to leverage your own home for a home exchange.

A home exchange—often called “house-swapping”—is a money-smart vacation idea that’s been around for a long time. With virtually everyone feeling the economic squeeze, some exchanges are more popular than ever before.

Why a home exchange? Since accommodations are usually the priciest part of a vacation, a home exchange saves money, allowing travelers to take longer vacations and perhaps splurge a bit on dining, tours, or shopping. Larger families appreciate how homes meet their needs for space, meals, and a good night’s sleep. And, home-swappers often say they enjoy “living like the locals,” especially when traveling internationally.

How it works. The basic idea of a home exchange is that two families agree to live in each other’s home (usually at the same time) at no cost—it’s considered an even trade. Exchangers find one another via home exchange website that provides detailed listings of available homes. Exchanges take place within the United States or internationally, and the length of stay is whatever the parties agree upon. Exchangers typically do not meet in person but get acquainted via phone calls and emails before the exchange happens. Details, including pets, the use of a car, and cleaning are all agreed upon ahead of time, usually in a written contract provided by the website.

What makes a house desirable? You might be surprised! As a general rule, home exchangers are looking for location, location, location. They want to explore attractions in your area, attend an event, or visit family. A beachfront house in California is highly desirable, as is a condo in an exciting city—and even a home in the suburbs will appeal to the right travelers. Because swappers are primarily looking for a convenient jumping-off point for their adventures, your home’s age, floor plan, and furnishings don’t matter too much, as long as it’s clean, comfortable, and accommodating.

Vacation homes are ideal. Whether it’s a rustic cottage on a secluded fishing lake or a condo at a popular ski area, a second home is ideal for exchanges. Logistically, you don’t have to vacate your primary residence, and you have more flexibility as to when the swap can happen. For this reason, many retirees—who often own second homes and enjoy freer schedules—find home exchanges especially appealing.

First steps. If you’re intrigued, start by exploring a few websites; you can view a lot of information for free. Home exchange websites typically charge an annual membership fee of $50 to $100 to list your home. If you decide to join a service, you’ll provide several photos and a detailed description of your home. You’ll also post your desired destination(s) and travel dates, and you’ll be able to peruse the homes that meet your criteria. It’s common to trade information with several homeowners before finding just the right match, and the process may take several months.

Focus on the basics. Once you’ve agreed to an exchange and are preparing your home for guests, think about what makes a hotel room enjoyable. A clean, clutter-free home is universally appealing, and comfortable mattresses and attractive bedding are a must. Your kitchen should be well organized, and internet access is a big plus. Your guests know they’re staying in someone’s home, so don’t worry about scuffed baseboards and well-worn furniture. Likewise, don’t expect five-star accommodations when you step into your host’s home.

Is a home exchange right for you? If the very thought of others living in your home and sleeping in your bed—or you in theirs—makes your palms go clammy, an exchange is probably not for you. But many travelers are hooked!

What are your summer vacation tips?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link