Real Estate Seller Tip: Home Updates for the Best ROI

Are you thinking about selling your home? Making home updates is usually a part of the process. Windermere Real Estate agent, Julie Hall,shares her expert tips on what home updates will yield the best return on investment, and they may surprise you.

I’m Ready To Downsize But How Do I Start?

By June Griffiths

Are you thinking about downsizing but don’t know how to make the tricky transition work? How do you buy a new place before you sell your current home?

You are not alone as many homeowners have the same concerns. They want to embrace a new lifestyle, take advantage of our ever-increasing values, and lock in a smaller home or condo in an area that they covet.

Below are some creative solutions that may help you make your dreams come true too. Keep in mind that everyone’s financial profile is different. One option might not work for you while another one will. It might even be a combination of a few of these.

Here are a few ideas:

HELOC – Home Equity Line of Credit. If you have enough equity in your current home, you may be able to get a HELOC to get a down payment for a conventional loan or to buy the new property outright.

Bridge Loan – These loans can bridge the gap between buying and selling. You can typically borrow up to 65% of the equity in your home with a maximum loan of $500,000.

Margin Loan – most individuals can borrow up to 50% of the balance in their liquid investment accounts (retirement accounts cannot be used). These loans are generally cheaper than a bridge loan and have no major tax implications.

IRA Rollover – Most retirement funds allow a 60-day rollover of funds. It’s very important to know that these funds must be replaced into the retirement account within 60 days or you may incur significant penalties and taxes.

Making a move, whether you are buying a larger home or downsizing out of your now empty nest, is a big decision. You’ll want the best professionals to help you. Ask your real estate agent to put you in touch with a lender who will help evaluate your financial situation and customize the best options for you.

June Griffiths is a Managing Broker in the Windermere Issaquah office and has worked in real estate since 1989. She can be contacted at june@windermere.com.

Empty Nesters: Remodel or Sell?

Your kids have moved out and now you’re living in a big house with way more space than you need. You have two choices – remodel your existing home or move. Here are some things to consider about each option.

Choice No. 1: Remodel your existing home to better fit your current needs.

- Remodeling gives you lots of options, but some choices can reduce the value of your home. You can combine two bedrooms into a master suite or change another bedroom into a spa area. But reducing the number of bedrooms can dramatically decrease the value of your house when you go to sell, making it much less desirable to a typical buyer with a family.

- The ROI on remodeling is generally poor. You should remodel because it’s something that makes your home more appealing for you, not because you want to increase the value of your home. According to a recent study, on average you’ll recoup just 64 percent of a remodeling project’s investment when you go to sell.

- Remodeling is stressful. Living in a construction zone is no fun, and an extensive remodel may mean that you have to move out of your home for a while. Staying on budget is also challenging. Remodels often end up taking much more time and much more money than homeowners expect.

Choice No. 2: Sell your existing home and buy your empty nest dream home.

- You can downsize to a single-level residence and upsize your lifestyle. Many people planning for their later years prefer a home that is all on one level and has less square footage. But downsizing doesn’t mean scrimping. You may be able to funnel the proceeds of the sale of your existing home into a great view or high-end amenities.

- A “lock-and-leave” home offers more freedom. As your time becomes more flexible, you may want to travel more. Or maybe you’d like to spend winters in a sunnier climate. You may want to trade your existing home for the security and low maintenance of condominium living.

- There has never been a better time to sell. Our area is one of the top in the country for sellers to get the greatest return on investment. Real estate is cyclical, so the current boom is bound to moderate at some point. If you’re thinking about selling, take advantage of this strong seller’s market and do it now.

Bottom Line

If your current home no longer works for you, consider looking at homes that would meet your lifestyle needs before taking on the cost and hassle of remodeling. Get in touch with a Windermere Real Estate broker to discuss the best option for you.

Did You Know?

Here are some fun “Did You Know?” stats as we wrap up 2016 (arguably one of the most fascinating years in the history of Northern Colorado Real Estate)

Here are some fun “Did You Know?” stats as we wrap up 2016 (arguably one of the most fascinating years in the history of Northern Colorado Real Estate)

Multi-Wow

Check out what’s happening in the multi-family market in Fort Collins.

Check out what’s happening in the multi-family market in Fort Collins.

100K

The City Manager for Fort Collins, Darin Atteberry, recently visited our weekly sales meeting. He had several interesting and valuable facts to share, including this…

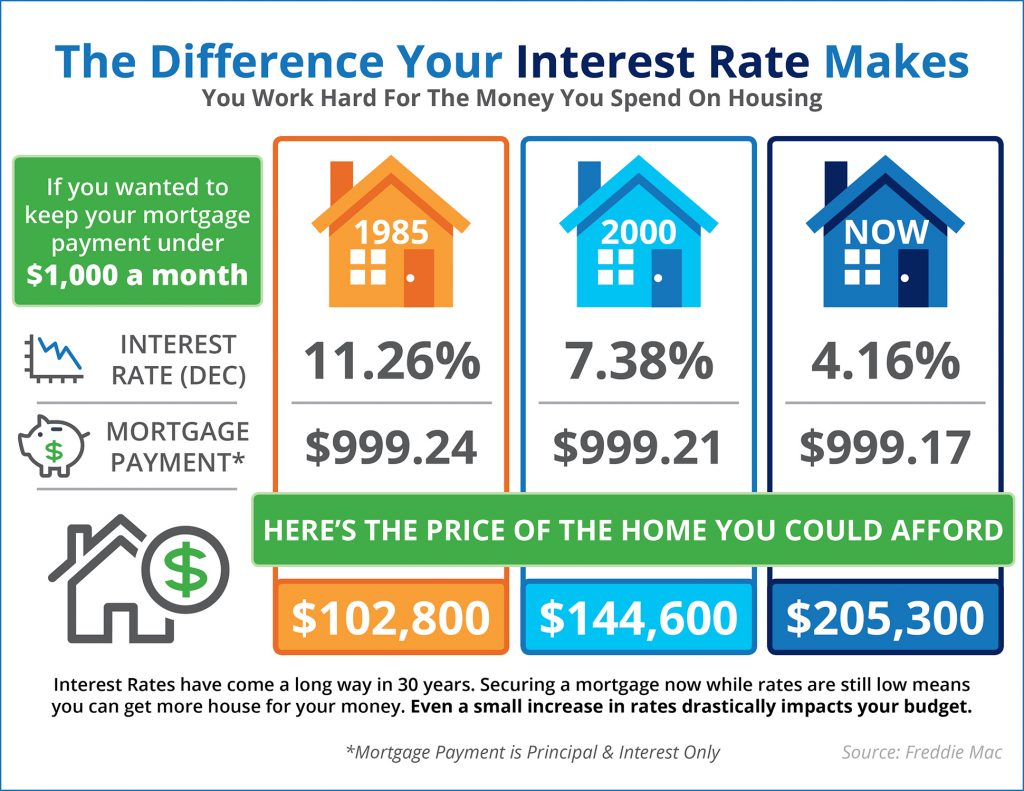

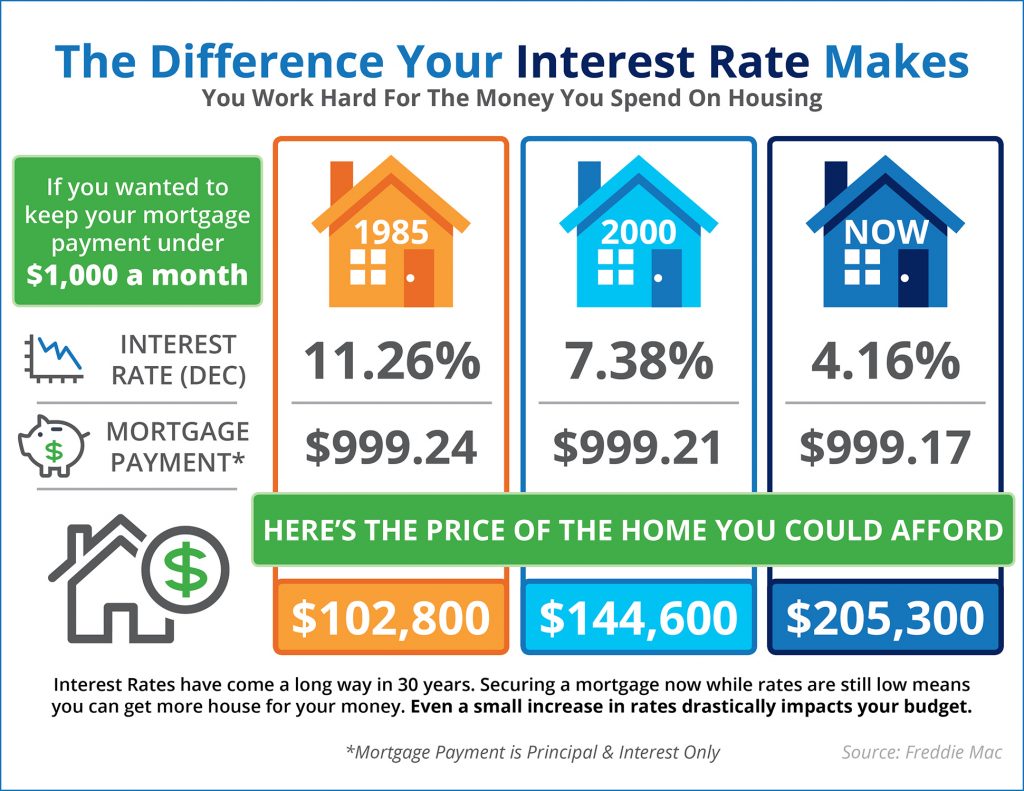

The Trump Tantrum

Since the election interest rates have jumped from 3.77% to 3.95% according to the Mortgage Bankers Association.

Since the election interest rates have jumped from 3.77% to 3.95% according to the Mortgage Bankers Association.

“This week’s increase in mortgage rates, being dubbed the ‘Trump Tantrum,’ is the biggest one week increase since the ‘Taper Tantrum‘ in June 2013,” said Bankrate’s chief financial analyst Greg McBride.

Economists say the anticipation of Trump’s pledged spending plans and tax cuts have investors anticipating some inflation and a dose of adrenaline to the economy which have caused a great deal of volatility in the market.

A little perspective is in order- rates today are still lower than the 3.97% recorded last year at this time. And, rates today are still essentially half of their long-term average.

Using a $400,000 home as an example with a 20% down payment, this interest rate increase translates to an additional $34 per month.

Many economists believe that we are now seeing the beginning of a long-term rise in interest rates.

source: Inman News

Interesting Takeaways

The Zillow Group just completed an extensive survey of home buyers and sellers. Here are some interesting takeaways from the research:

- Half of today’s home buyers are under the age of 36, and 47 percent are first-time buyers. Solo home buyers are in the minority;

most buyers are shopping with a spouse or partner (73 percent).

most buyers are shopping with a spouse or partner (73 percent). - Eighty-three percent of buyers are shopping for a single-family house. Their top considerations are affordability and being in a safe neighborhood.

- Today’s sellers are most often members of Generation X (38 percent), and the majority (63 percent of all sellers) are listing a home for the first time.

- Most sellers are trading their homes for one they see as an upgrade, seeking a median of 100 more square feet and a home that costs an average of 11 percent more.

- Sellers’ top regret was that they didn’t take more time to prepare for a sale (30 percent). (By the way, Windermere’s Certified Listing is a proven 10-step process which prepares both the home and our clients for the sale. Let us know if you want to know more about it.)

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link