Q1 2021 Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

REGIONAL ECONOMIC OVERVIEW

Following the decline in employment last winter, Colorado has started to add jobs back into its economy. The latest data shows that the state has now recovered more than 219,000 of the 376,000+ jobs that were lost due to COVID-19. This is certainly positive, but there is a long way to go to get back to pre-pandemic employment levels. Denver and Fort Collins continue to have the greatest improvement in employment, but all markets show job levels well below pre-pandemic levels. With total employment levels rising, the unemployment rate stands at 6.6%, down from the pandemic peak of 12.1%. Regionally, unemployment levels range from a low of 5.6% in Fort Collins and Boulder to a high of 6.7% in Greeley. COVID-19 infection rates have started to increase again, and this has the potential to negatively impact the job market. I am hopeful that the state will not be forced to pull back reopening, but this is certainly not assured.

COLORADO HOME SALES

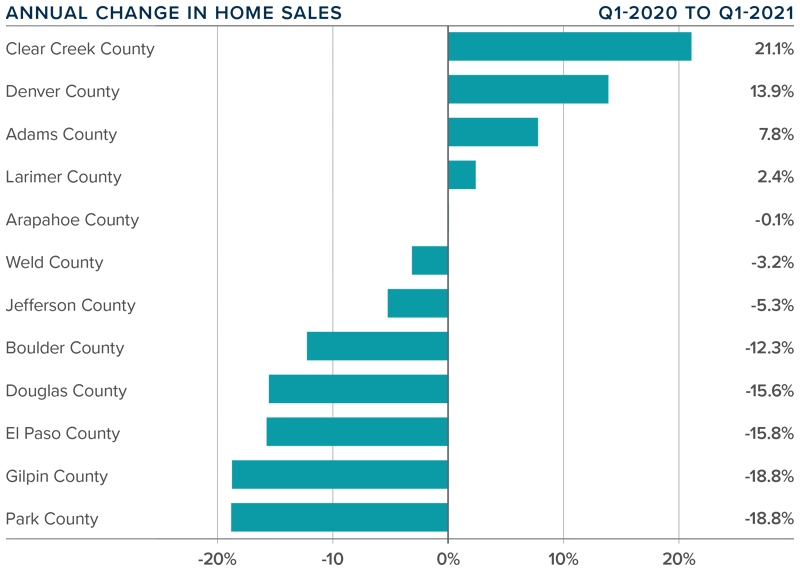

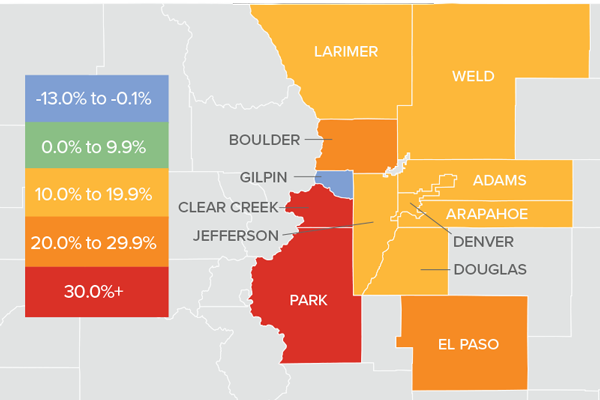

❱ 2021 started off on a bit of a sour note, with total sales down 1.2% compared to the same period in 2020. Sales were 29.2% lower than in the final quarter of 2020 as 8,645 homes sold.

❱ Sales were higher in four of the counties contained in this report, were essentially flat in one, and dropped in seven. It was pleasing to see significant sales growth in the large counties of Denver and Adams.

❱ Another positive was that pending sales, which are an indicator of future closings, were 4.8% higher than in the fourth quarter of 2020 and 5% higher than a year ago.

❱ The disappointing number of home sales overall can primarily be attributed to the woeful lack of inventory. Listings in the quarter were down more than 61% year over year and were 40.6% lower than in the fourth quarter of 2020.

COLORADO HOME PRICES

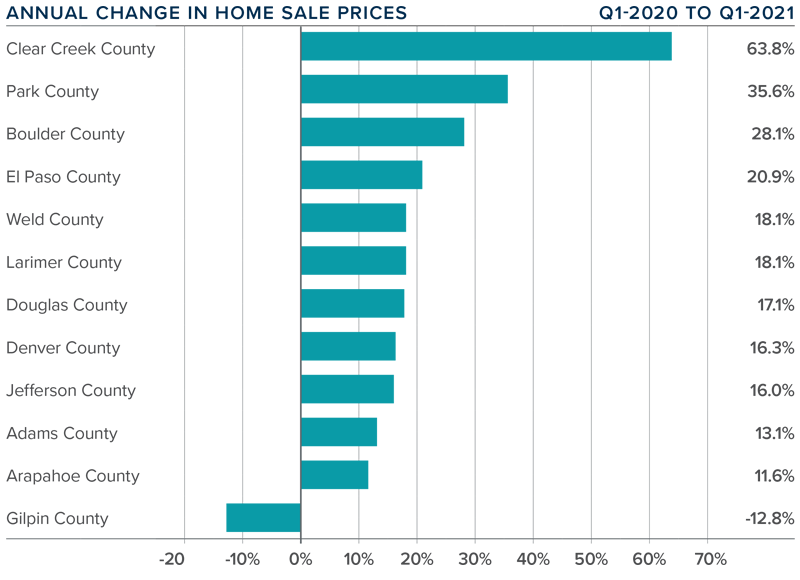

❱ Prices continue to appreciate at a very rapid pace, with the average sale price up 16.5% year over year, to an average of $556,100. Home prices were also 4.4% higher than in the fourth quarter of 2020.

❱ Buyers appear to be out in force, and this demand—in concert with very low levels of inventory—continues to heat the market.

❱ Prices rose over last year across all markets covered by this report, with the exception of the very small Gilpin County. All other counties saw sizeable gains and the trend of double-digit price growth continued unabated.

❱ Affordability levels are becoming a greater concern as prices rise at a far faster pace than wages. Even though mortgage rates have started to rise, they haven’t yet reached the level needed to take some of the heat out of the market.

DAYS ON MARKET

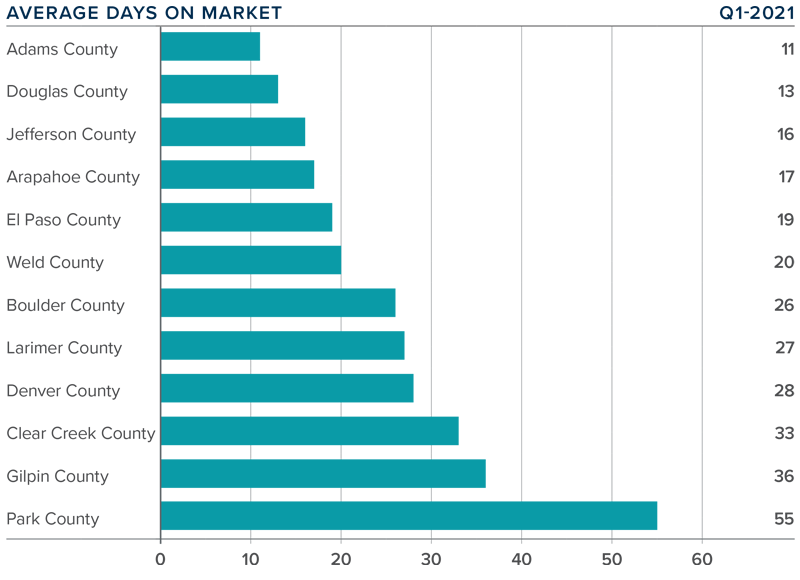

❱ The average time it took to sell a home in the markets contained in this report dropped 20 days compared to the first quarter of 2020.

❱ The amount of time it took to sell a home dropped in every county contained in this report compared to the fourth quarter of 2020.

❱ It took an average of 25 days to sell a home in the region, down one day from the fourth quarter of 2020.

❱ The Colorado housing market remains very tight, as demonstrated by the fact that it took less than a month for homes to sell in all but two counties.

CONCLUSIONS

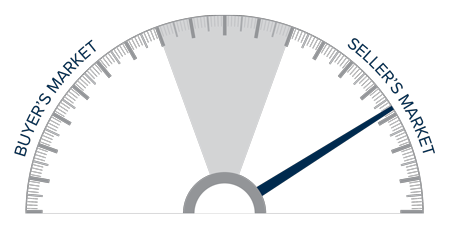

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The relatively low level of home sales is not a surprise given how few choices there are for buyers. Sellers are certainly benefitting from strong demand, as demonstrated by the significant price growth. I maintain my belief that there will be an increase in inventory as we move through the year, but it is highly unlikely that we will see a balanced market in 2021.

Given these factors, I am moving the needle a little more in favor of sellers, as demand is likely to continue to exceed supply.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Re Bubble

The activity in the Front Range market is causing us to hear the bubble question again.

People are curious to know, based on recent growth in price appreciation, if we are in a housing bubble.

This question seems to crop up when prices go up.

While we do not believe that the current double-digit price appreciation is sustainable, we firmly believe we will not see prices crash or see any kind of a bubble bursting.

Here’s why we think that…

This past Tuesday we hosted a private online event for our clients which featured our Chief Economist Matthew Gardner.

Matthew is well-known and well-respected in the industry. He is often quoted in leading real estate publications.

He sees four reasons why there is no real estate bubble that is about to pop in Colorado.

- Inventory is (incredibly) low. The number of homes for sale is down over 40% compared to last year. The market is drastically under-supplied. Based on simple economic principles of supply and demand, inventory would need to grow significantly for prices to drop.

- Buyers’ credit scores are very high. The average credit score for buyers last month, for example was 759. So, by definition, average buyers today have excellent credit which means there is low risk of them walking away from their mortgage and causing a foreclosure crisis.

- Buyers have high down payments. On average, buyers are putting 18% down on their purchases. This means that prices would need to fall by a considerable amount in order for the average buyer to be ‘upside down’ on their mortgage.

- Owners are equity rich. Well over a third of property owners along the Front Range have more than 50% equity in their homes. This means that a severe economic downturn causing a slew of distressed properties to hit the market is highly unlikely.

Bottom line, as Matthew Gardner reminded us, what we are experiencing in the economy today is a health crisis not a housing crisis.

If you would like a recording of the private webinar we would be happy to send it to you. Just reach out and let us know.

Economic Update with Matthew Gardner

Exclusive Invitation!!!

Tune in on Tuesday, October 6, 2020 at 9:00am to meet with Matthew Gardner, Windermere Real Estate’s Chief Economist LIVE and get your chance to ask him questions. He’ll be discussing the housing market, employment and the effects of COVID-19 on the local and national economy.

As one of the only real estate companies in the US that has a Chief Economist on staff, we have exclusive insights into the housing market, economy and government happenings. This is a one of a kind event for clients and friends of Windermere Real Estate in Colorado.

To sign up, please contact your Windermere Agent or message us to get the link. Seating is limited in digital meeting room so get your seat!

(If you can’t attend live, you can register to automatically get the recording.)

Matthew Gardner Weekly COVID-19 Housing & Economic Update: 6/15/2020

On this week’s episode of “Mondays with Matthew,” Windermere Chief Economist Matthew Gardner provides an update on the forbearance program and what type of effect we can expect it to have on the US housing market.

Matthew Gardner Weekly COVID-19 Housing & Economic Update: 6/1/2020

This week on “Mondays with Matthew”: Now that things have settled down somewhat following the initial impact of COVID-19, Matthew dives into the topic of mortgage rates. Will they go below 3%? Matthew discusses this and the factors that have formed his updated 2020 and 2021 mortgage rate forecast.

Why No Crash

This week we hosted our clients and friends for a special online event with our Chief Economist Matthew Gardner.

Matthew talked about a variety of topics that are on people’s mind right now including home values.

Matthew sees no evidence that home values will crash and actually sees signs that they may rise this year nationally.

Here’s why he says this:

- Mortgage rates will remain under 3.5% for the rest of the year so there won’t be any interest-rate pressure on prices

- Inventory, which was already at record-lows, will drop even further keeping the supply levels far below normal

- New home construction will continue to be under-supplied and will be nothing like the over-supplied glut of inventory that we saw in 2008

- The vast majority of employees being laid off and furloughed are renters

- Homeowners have a tremendous amount of equity in their homes right now compared to 2008 which will prevent an influx of short sales and foreclosures

If you would like to receive a recording of the webinar we would be happy to send it to you. Feel free to reach out and ask for the link.

Special Event

On Wednesday April 22nd you are invited to a special online event with Windermere’s Chief Economist Matthew Gardner.

He will be giving his insights into the U.S. economy and what that means for real estate along the Front Range of Colorado.

You will hear the answers to the biggest questions we are hearing from clients now like “do you think housing prices will crash?”

This event is exclusively for clients and friends of Windermere Real Estate. To receive the registration link simply comment on this blog or reach out to your Windermere real estate broker.

Many of you have heard Matthew speak at our Market Forecast events we hold each year in January. He is famous for making complex economic dynamics very simple to understand.

You will get useful and valuable information which will give you clarity about where the market is headed and when we can expect the economy to improve.

For example Matthew predicts unemployment to hit 15% by the end of June, but then to improve to 8% by year-end and 6% by this time next year.

Again, if you would like the link just comment on this blog or reach out to your Windermere broker.

Rate Forecast

Here is our interest rate Forecast for the next year.

Our Chief Economist, Matthew Gardner, predicts that rates for a 30-year fixed mortgage will stay between 3.8% and 3.9% for 2020.

He doesn’t see rates going above 4.0% until at least the first quarter of 2021.

This is obviously great news for buyers as their payments will stay much lower as compared to having a rate at the long-term average of 7.5%.

If you would like to see the slides from Matthew Gardner’s Forecast presentation, we would be happy to get those in your hands. Just let us know if we can help!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

0 Comments

Comment